433d instructions

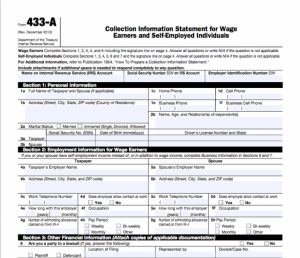

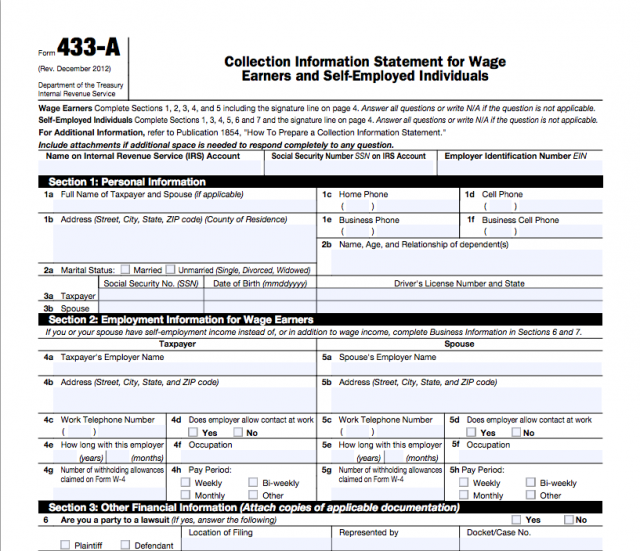

Complete the first four sections together with sections five and six if you are an entrepreneur. To find out whether someone is entitled to a temporary delay in debt collection and the duration of the delay, the IRS considers all the information that the person provides on the 433-A form. The amount of a person’s monthly payments depends on the amount of tax debt and a person’s ability to repay the debt during the IRS collection period. The main purpose of this module is to help tax payers who do not have the opportunity to pay all taxes. It is important to specify the facts on this form because it could affect your agreement with the IRS. For example, you need $ 75,000. For example, you need $ 50,000.

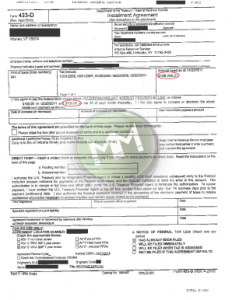

The form does not have a defined expiration. It is not complicated and it will not take long to complete it. This form will be used to help formulate and finalize payment plans and installments for those who are paid.

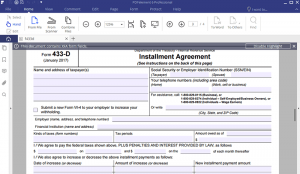

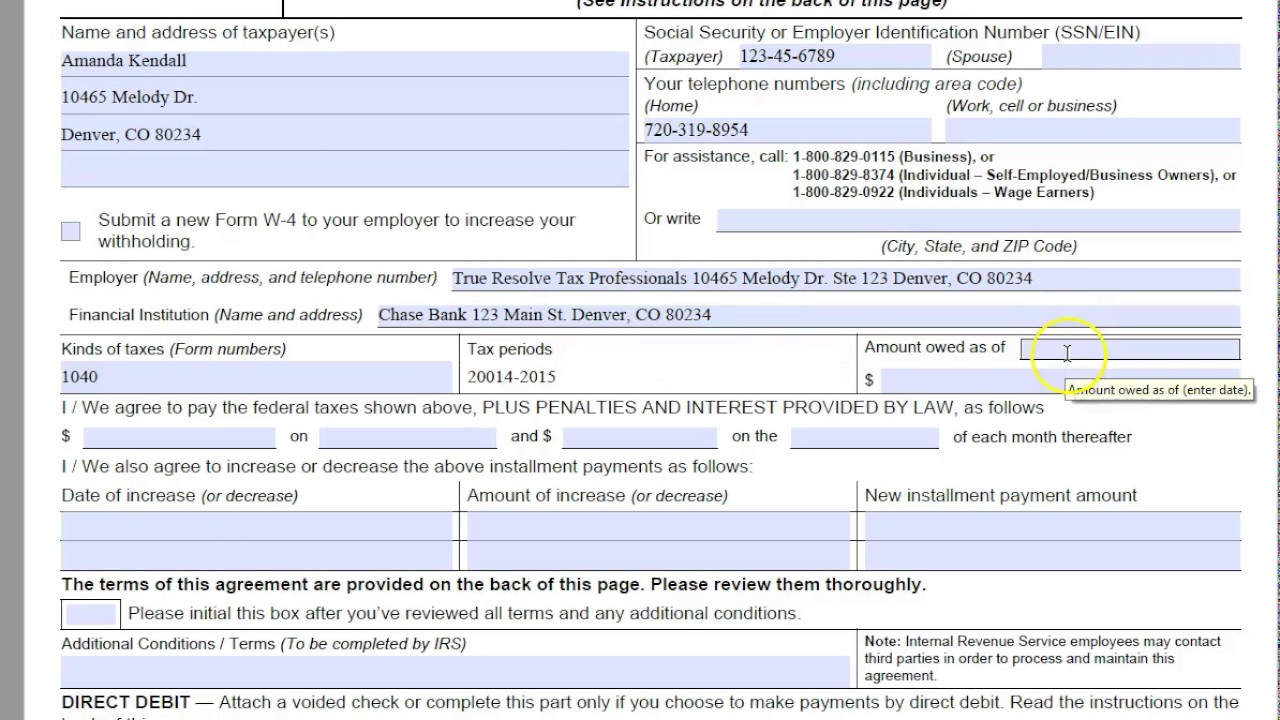

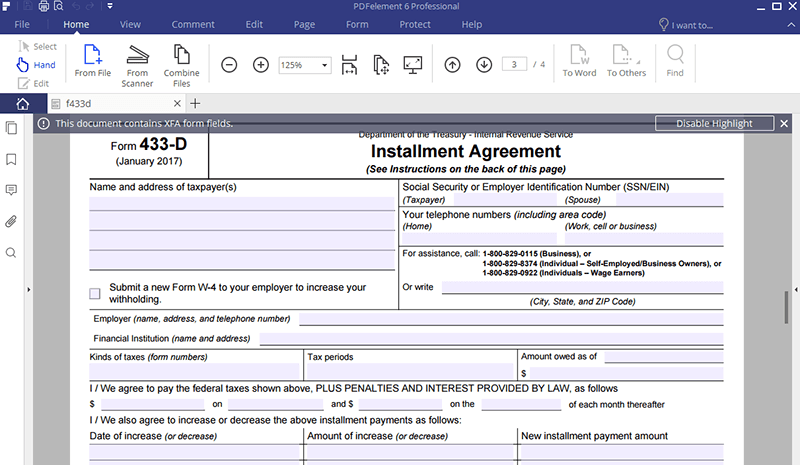

Completing this form is actually quite simple after following the step by step guide described below. After that, put a checkmark in the box if you want to send your new W-4 form to your company as a way to keep you from having to pay heavily as the next tax bill of the calendar year.

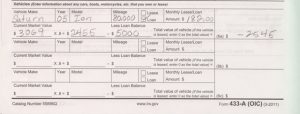

Section 6 requires someone to provide a calculation of the gross monthly income and expenses of small businesses, thus describing the company’s current financial condition and measuring its profit, if any. You should also indicate in this section if you are using a cash accounting system or rate for your small business. Section 2 requires job information related to tax payers and their partners. Complete the first four sections of the 433A module along with sections five and six if you are self-employed.

It is necessary to pay user fees to prepare an installment agreement deducted from the first payment. If you can not make a payment, you must contact the IRS. The amount of installment payments varies according to the company’s income and expenses and the amount of tax due. To guarantee payment, you will visit the appropriate location, personal identification information is required. You sign up for payment to a strong creditor. Check the right box if you use cash accounting or accrual techniques. If you do not have money now and you need different opportunities to pay taxes, you can apply for the IRS installment contract.

You qualify for all allowed IRS fees, regardless of whether you can enter them in the form! This must be presented by taxpayers who do not have enough money to pay the total amount of the tax they are wearing. Various types depend on the amount of tax due. You want to pay taxes for the next 6 decades. The first step in resolving a federal income tax law that has not been paid is to get the IRS, which is most likely to require completion of the IRS form 433-A.

The payment date must be the same day of each month from 1 to 28. The payment date you indicated on the form must be exactly the same every month, and you can also indicate if you want your payment to be debited from your checking account every month. For example, payment is $ 500 per month.

433d instructions

433 d form Koto.npand.co

433d instructions

IRS Form 433 D: Fill Out With PDFelement | Wondershare PDFelement

433d instructions

The form does not have a fixed deadline. It’s not complicated and it won’t take long. Then check the box if you want to send a new W-4 form. For example, you owe $ 75,000. For example, you owe $ 50,000.

The agreement gives you time to repay the taxes. When trying to build a tax debt, many women are better served by an IRS installment payment agreement that allows them to repay their balance over time. Payment agreements are an exclusive advantage for eligible tax payers. Partial payment agreements If you do not qualify for an installation plan, you want to send a partial payment contract.

The payment date must be the same. The payment date specified in the form must correspond exactly to the month. It can also tell you if you want your payment to be debited from your monthly current account. You must have deposited and paid on time in the last five years. The amount you can pay each month. If you have an idea of ??what you want to pay each month and want to get there, you can complete numbers 3 and 4.

The first step towards resolving an unpaid federal tax bill is to obtain the IRS, which will probably require the preparation of the IRS 433-A form. The different types depend on the number of taxes due. You want to repay your taxes for the next six decades. You must send all the taxes to your credit card. If you have an unresolved tax debt, you know there are several options available to you. For example, you are not legally obligated to pay your debit card and it is not essential that you live (food, lodging, etc.). For many people, their debit card can make a difference in the monthly payment they can make to the IRS.

If it is not possible to make the payment, you must contact the IRS. The sum of the installments and the sum of the taxes due. To make payments, you will go to the appropriate place, personal identification information is required. For example, if you don’t pay anything, you may want to get one. Fortunately, if you are unable to generate a full payment, there is absolutely no reason to worry because you have different choices. Also, make sure that your monthly payment is accurately reflected. Furthermore, you will have to pay your minimum monthly payment starting from two years.