dave ramsey budget forms pdf

To ensure prosperity with a total makeover, Dave Ramsey offers many secrets to success. He is a famous person when it comes to the principle of getting out of debt. This has created a system that provides debt direction for anyone to improve the overall financial framework, but there is more in the picture than in simple debt relief.

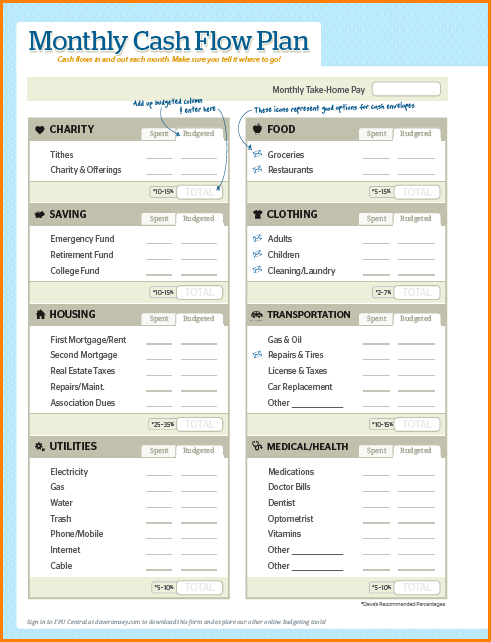

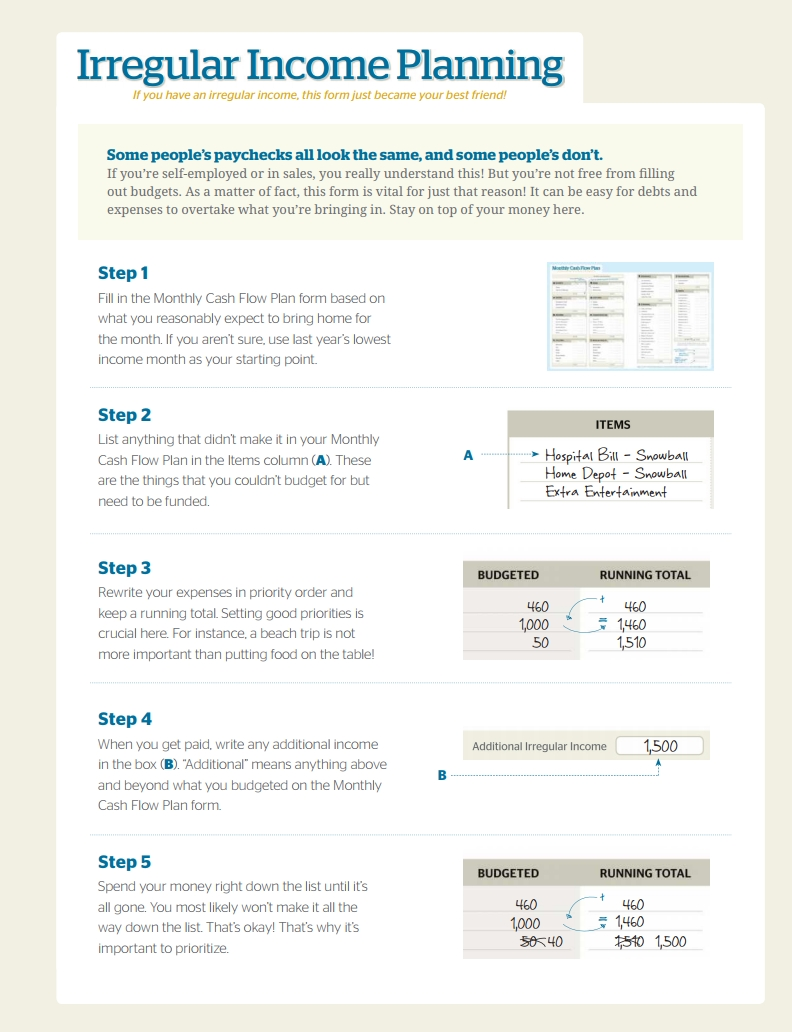

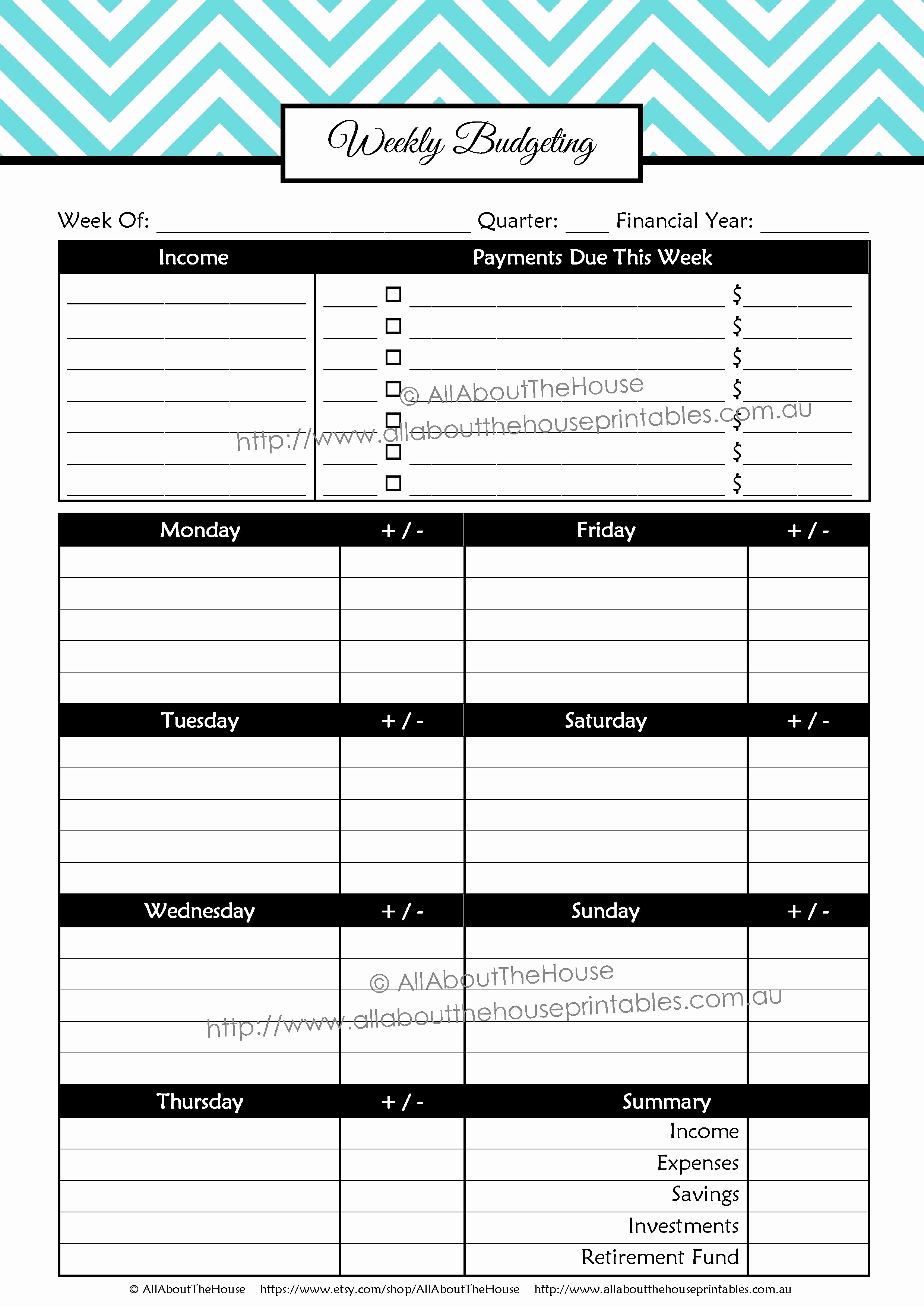

You may have a number of reasons why you want to share your financial plan with a partner so that you can oversee expenses together, with relatives or friends to act as coaches of responsibility to help you follow, or even if a financial advisor is trustworthy, sets a budget and clings to it’s not easy, but this is the best approach to be responsible for your finances. How to make a budget. The money supply budget is a functioning system. After adjusting your expenses, so that your income is greater or equal to your expenses, you are ready to plan your expenses. The budget is very simple and only takes ten minutes to start. At the same time, you can use Dave’s Ramsey budget module to analyze all the risks you might have.

The best proactive method to keep your debt free is an important amount in the first place and practice smart spending. For example, if you need to be aware of how much money is spent on food or medicine, you need to use invoices and amounts. Then you will understand how much money you need for each period. As a result, everyone will realize what is spent by the family and how much better to save and collect the amount you want. To be able to understand your income, you need to understand how much money you have and how much money you make.

Even though having a credit card is the easiest way to start building credit, this does not mean that you will maintain a monthly balance. In fact, credit cards and credit lines can be ideal for getting out of debt if they are used in the right way. If you are young and have to manage credit, then you can apply for the next mortgage, it’s important to realize that you don’t need to have debt, so start building your credit score. For those who have debt, you want to generate your budget so you can pay as quickly as possible. The ideal thing to do is all types of debt in the first place. Regardless of whether you get debt or not, you might be able to use help to make sure you control your expenses. Perhaps the best method for paying off debt is with the snowball procedure.

dave ramsey budget forms pdf

Dave Ramsey Budget Forms Template: Free Download, Create, Fill

dave ramsey budget forms pdf

Dave Ramsey Budget Forms Template: Free Download, Create, Fill

dave ramsey budget forms pdf

Taxes are among the most important leeches of wealth. The poor use debt to buy things that enrich the rich. On a last note, 1 which is completely true, no matter what method you use to get out of debt, the main problem is to keep discipline and the very good expenses occur in order to keep your debt free. The best way to pay off your debt is perhaps the snowball procedure of debt. The amount of the debt may also affect the possibility of settlement.

The first five chapters of the book Total Money Makeover deal with the psychological hurdles you must overcome to create finances. Basing the budget can be done using one. Precise planning and auditing will help a person not to worry about the bad days of his life. My plan is not the secret formula of Coca-Cola. How to produce a budget. All the rich have a budget. In addition to that, you can use Dave Ramsey’s budget modules to analyze all the risks you may have.

If you do not understand how money works, you will never create wealth. Find out where your hard earned winnings are going. As a result, everyone will know what the family is spending and how much better it is to save and collect the money you want. The less tax you have, the more you earn.

Most people will still be able to do the work for money. Obviously, there are a number of rich men and women who never give money, but most millionaires and billionaires are extremely active in their philanthropic work. So basically, you lost money at home and you lost your job. For example, if you need to know how much money you spent on food or medicine, use the bills and summarize them.

Any choice is better than no choice. So once you have chosen to start your business, you have to do it part-time without leaving your job. Many people become paralyzed when an important decision needs to be made. It is essential to make the right decision to determine who will manage the largest possible financial investment.

The other part of the article that I wanted to stress is that, although YOUR experience has never told you in church that people were poor since they were lazy, that’s certainly the lesson I see in your daily show, because people are almost always in debt as a result of gloomy decisions or loss of income. If you have not already done so, come back and read the first article here. The book is simple and informative without a lot of technical details. The next area of ??the book deals with the wealth of the building. This will teach you the true laws of wealth creation.

Dave Ramsey is a pretty competent guy on the principles of debt relief. Dave Ramsey is great, but you want a big debt in your life. Working with a Dave Ramsey SmartVestor Pro has a huge price and we would really like to help you understand how to add it to your financial picture. He suggests that home lines of credit and credit cards are not a good idea if you want to get yourself out of debt. He teaches a lot of good information in his books and CDs, but I disagree on some points.