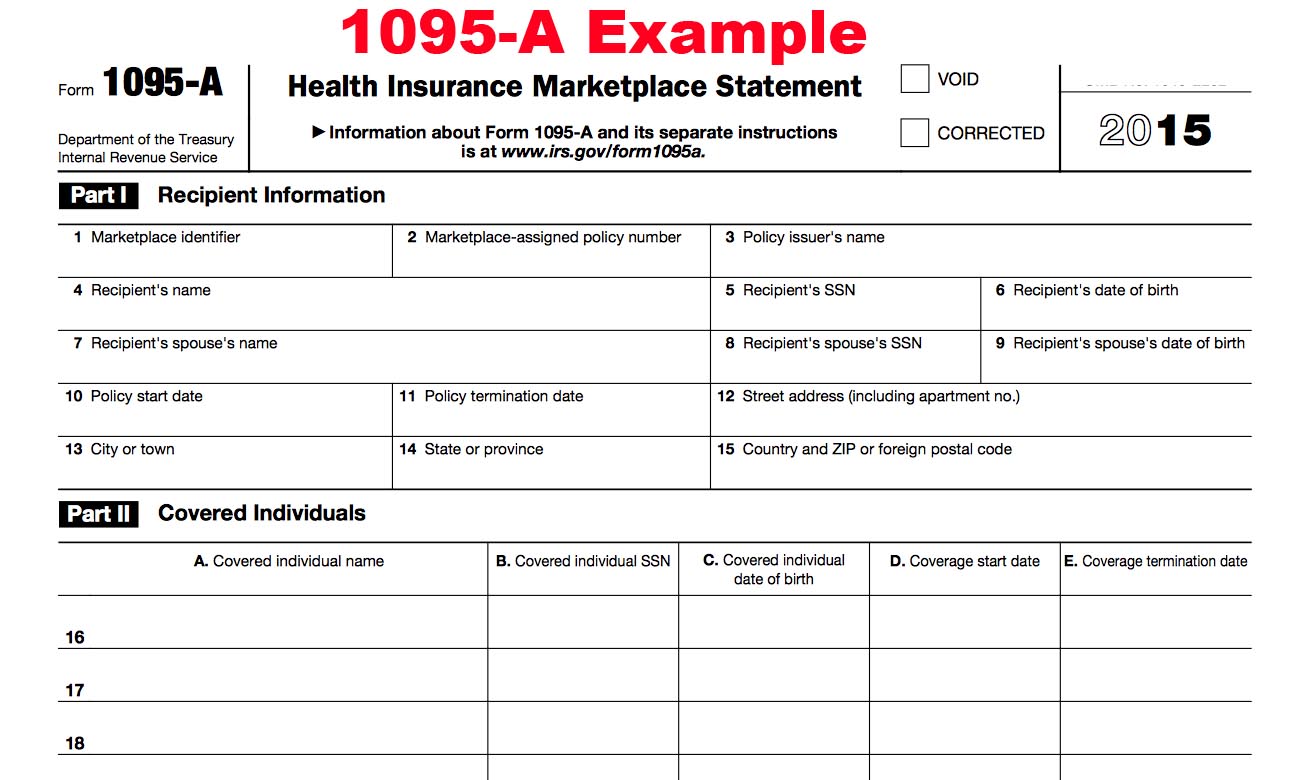

form 1095-a sample

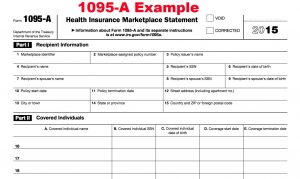

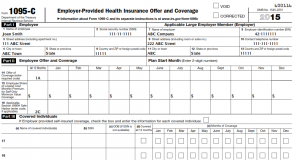

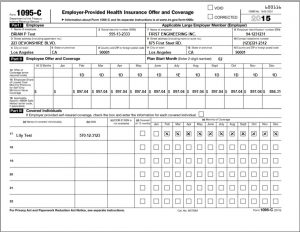

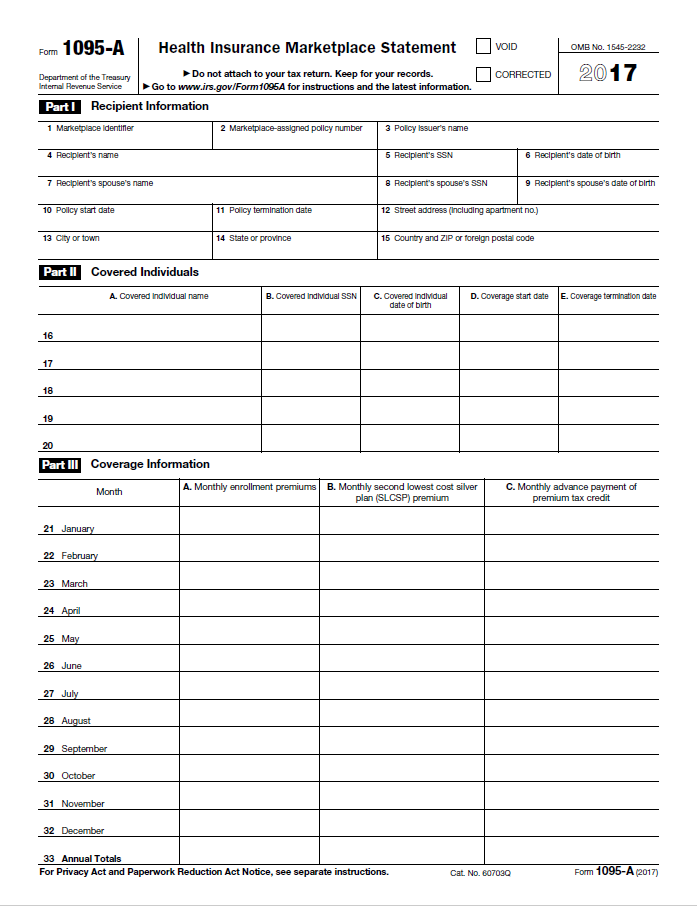

You can not receive all 3 forms. As a customer, you do not need to produce this form because you are made by an insurance company. Those interested in Obamacare prizes will end up being a huge problem for tax payers. You may not have received the form because you have not found a subsidized health insurance, which is good news because you already have a policy or bad news because you are likely to pay a fine. Therefore, no instructions for this form. The 1095-C module is distributed in a program very similar to the W-2 module, but it is not a W-2 module. You will get a 1095-A tax form if you purchase a health insurance policy market.

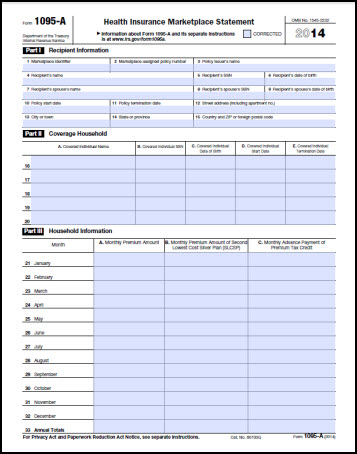

This document has many versions based on the organization responsible for your insurance. Full documents must be submitted by March 31st. This is a reference document.

If you are eligible for exemption on the market, you will be given the document on the rights to be presented with your tax. If you qualify for an exception, you must register. The exception of religious sects is only an exception available only on the market.

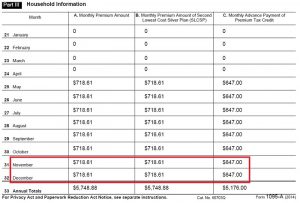

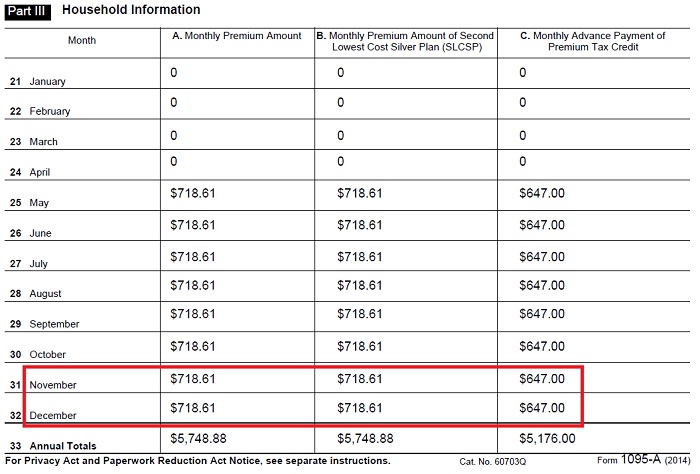

How do I get the money or not? By law, you have to pay your income when you have a decent income. You are eligible for tax returns if you need more tax forms processed than normal return documents or if you already have your income tax. If you have underestimated your income, you may have supported the government because they paid you more. O’Donnell overvalues their income.

Underestimating or overestimating your income can affect your repayment or the amount of your debt. To make sure you get the right amount, you need to calculate your income as accurately as possible depending on the information you have.

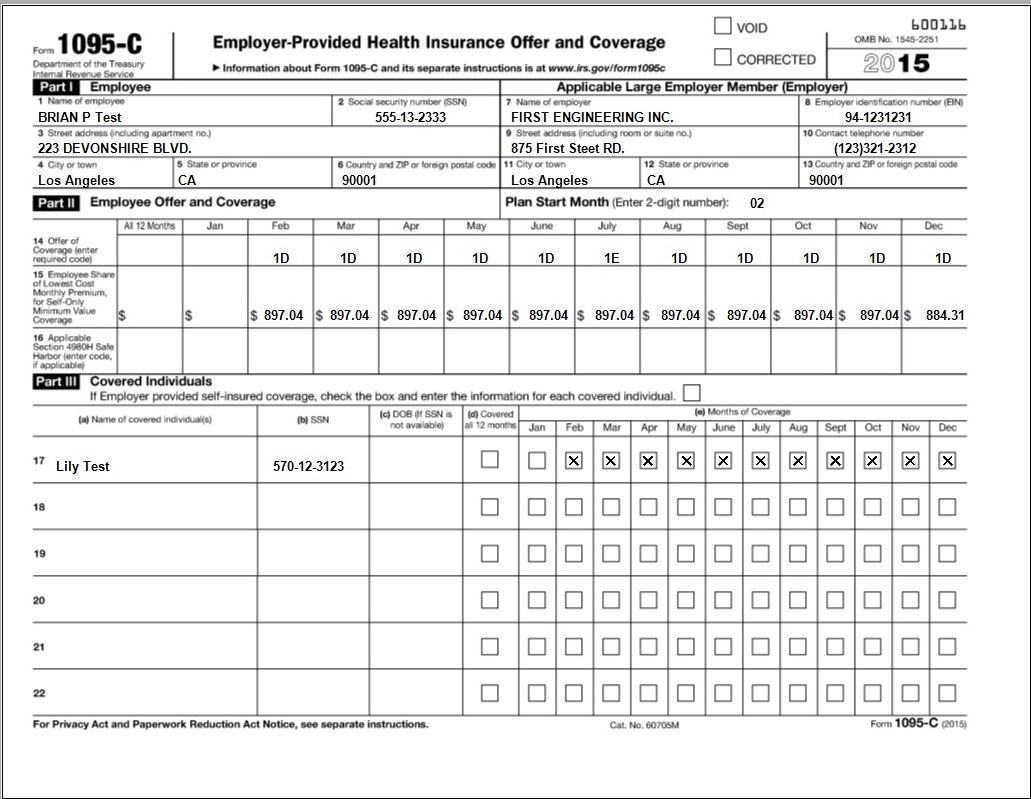

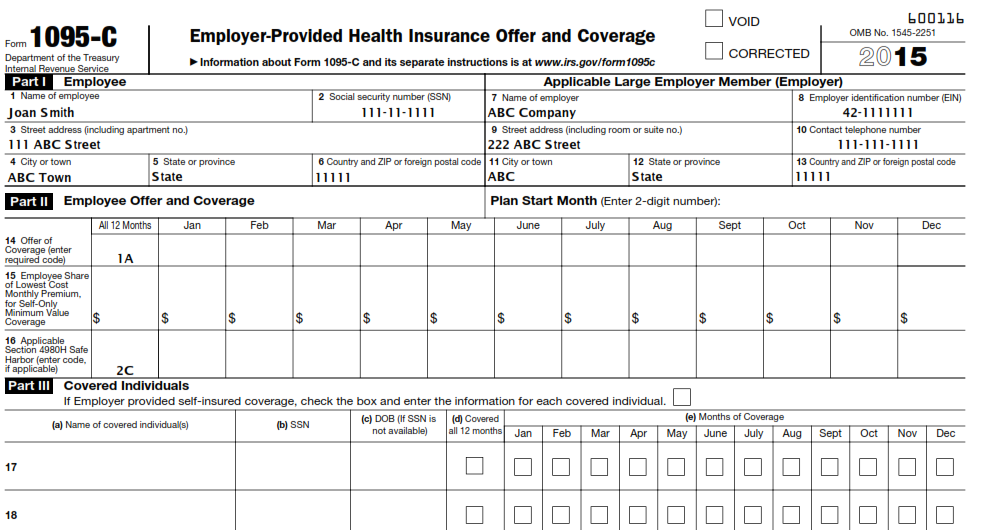

If you choose health insurance through the Marketplace, you will receive Form 1095-A. On the other hand, if the amount paid to your insurance company actually exceeds your credit. In addition, you will receive 1095-B from the insurance provider and 1095-C from your company. Your insurance provider offers you a 1095-A blank. The web-based health exchange insurance company gives you the form 1095-A.

form 1095-a sample

2017 Form IRS 1095 A Fill Online, Printable, Fillable, Blank

form 1095-a sample

Form 1095 A Health Insurance Marketplace Statement 1095A

form 1095-a sample

You don’t have to wait to receive the form before presenting your taxes. You can get two or more forms of taxation per year. You can also get a similar module, 1095-C, if you work for a company with more than 50 employees. Form 1095 – A form is provided by insurance companies to anyone covered by a health care scholarship. Note that Form i-864 does not need to be authenticated. Form 1040, page 2 contains all the data necessary to calculate your tax obligations.

An example of a letter is proposed in the article below. The official letters occupy a vital place in the world of the market. It is essential to understand how to write an official letter. Higher letter writing skills will allow you to write appropriate donation letters.

In March, you will receive your 1095-C form. The form can also be used to complete a person’s tax return. He recalled that an FTA member should only be interested. 1 type of health form is a health tax Next calendar year, you may need to complete both your personal tax return. 1095-c information to prepare the tax return.

Internet service Despite an exceptional model, you may not know where to start. Thus, models are the best way to prepare an authorization receipt by yourself. You will meet various models and formats of the Web and legal work.

If someone is enrolled in government-sponsored insurance, they must be able to obtain Form 1095-B from the provider of the insurance policy. Finally, if he is employed in a large company, he is entitled to receive a 1095-C form from his employer. A person can have medical insurance and benefits when claiming a claim. Explained by a farmer, explained by a farmer, A-B or A-C or A-C or A-C or A CA

You probably have questions. You will answer the most frequently asked questions before they are asked. Contact your health care provider if you have questions about the 1095-B form they sent.

You are looking for reliable geographic and personal information on demographic data. You will surely know the information you want to include. Your information is secure and protected. You must give us the information. With this type of strategy, it will be easy to communicate information about changes. Make sure you provide accurate business information when writing a business letter. Keep the note of the positive letter and make sure you have the information you present in a few lines.