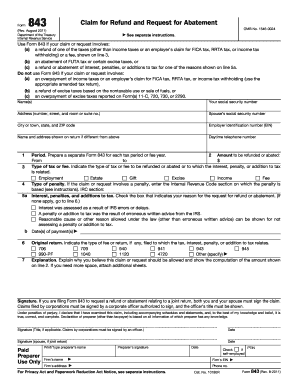

form 843

Forms are updated regularly, so make sure you get the latest version of the IRS to stay in compliance with the policy. Or you can generate forms for users. You can read more about this here. Forms are the most common way for your users to talk to your application. You can use the same form several times. Depending on your category for taxpayers, there are several ITR modules. New software for modules We have many users and many smooth presentations through SeamlessDocs. A person can obtain an invoice form that is completely free from the Web for commercial use.

This model is a well-documented model, with fantastic support always ready to solve any problem. It has all the important features like graphics, shapes, tables, a collection of user interface elements and many other pages. You can start with their free form template or you can start with a blank form.

This model has a responsive layout and can be used with most browsers. You must ensure that the model is as short as possible that prevents the possibility of destroying a profitable future. This model offers you a lot of this. It has the possibility to enter legal information in the section that prepares legal documents. The Leaf Admin Template provides well-written documents along with good support that helps you in your project a fantastic thing.

Computer software has a very simple and easy user interface for invoicing. Enterprise resource planning also refers to how ERP software integrates and manages important aspects of a company such as accounting. This program has been designed to offer the best possible user experience. In addition, it supports many users. You don’t need complicated desktop software if you have free tools out there.

You can find more details about our plans here. There are many sites on the web that provide invoice forms that are completely free for users. In addition to offering different tactics to pay in the office, you can receive online payments.

In the market, there are unique companies that offer unique choices. After that, I could not hesitate to switch my business from HSBC. After all, you are in business to make money, not just spend it!

An invoice is a prior statement about the value and high quality of the work provided by the supplier. Sending invoices is important after you sell globally. The correct invoice is a symptom of an expert business. Preparing the invoice is simple. Other people will choose an e-mail invoice.

Invoice is of course the most important part of business transactions. In addition, invoices contain more in-depth information about the items purchased compared to very simple bills. Therefore, they are carefully prepared and stored for a long time. Making invoices is one of the most important activities involved in a company. Even though the purchase of goods, but the payment invoice acknowledged that it was not done immediately, but after a while. Making an invoice requires a lot of time and effort when done manually: it is always useful for organizations to use the Internet.

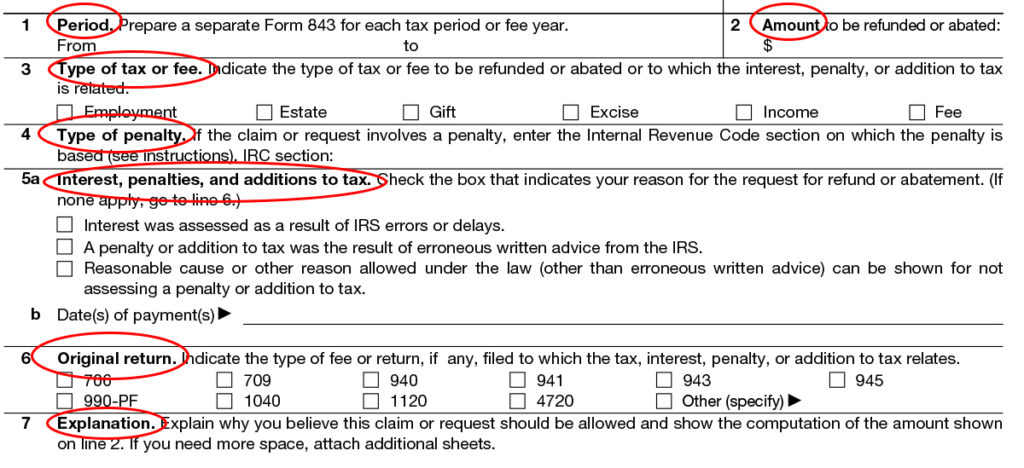

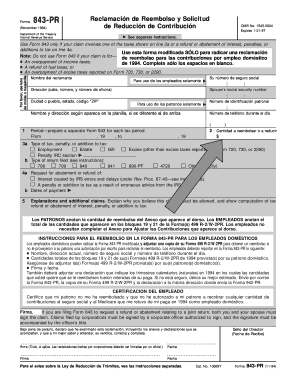

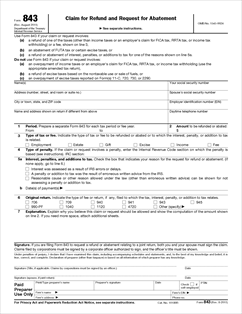

form 843

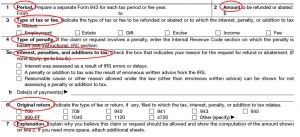

2011 2018 Form IRS 843 Fill Online, Printable, Fillable, Blank

form 843

Irs For Form 843 En Espanol Fill Online, Printable, Fillable

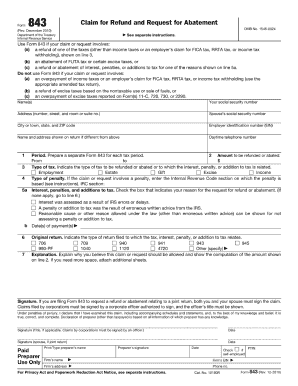

form 843

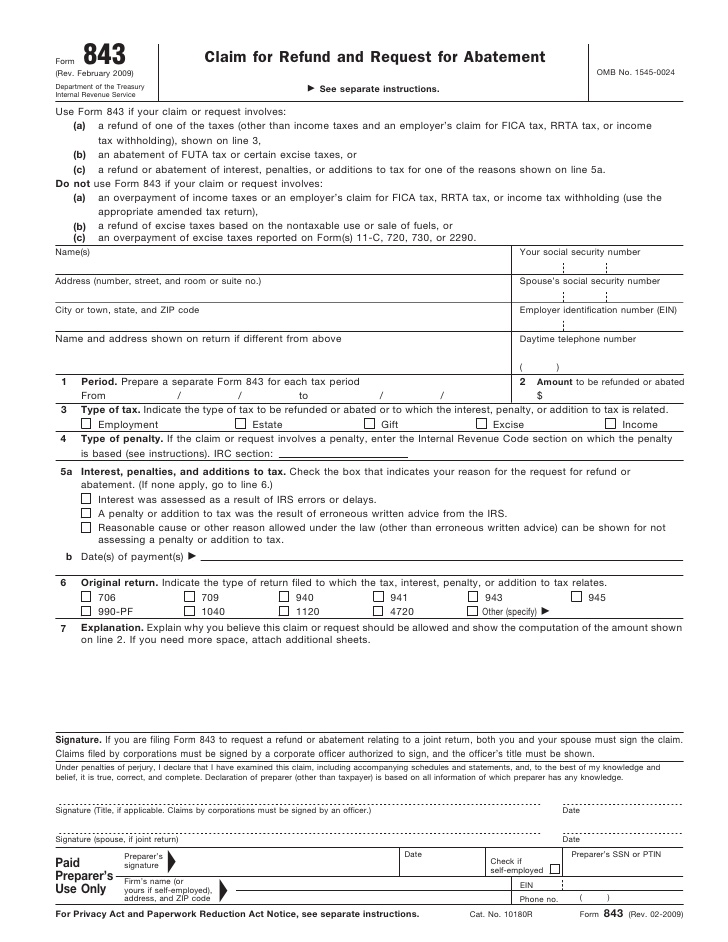

Form 843 could be used to submit the application. It is not possible to be asked to submit Form 843 under all conditions. If you are preparing your Form 941 All you have to do is send Form 8843 via email. The steps described below may show you how to complete the IRS 843 form.

You should not present a modified return only to correct mathematical errors. If you do not have to file an annual tax return because you do not have taxable income, you should have access to Form 8843. You must first prepare a new tax return using the 1040 form and any additional programs, you must enter the modified data on Form 1040X.

To get started, you will need a copy of the last stub and tax return. Please read the entire page as it can help you complete your tax return. You are the one who has the right to collect interest, two on overpayment. For the best results, you need to know if you have the right tax knowledge. This is the one you are perfectly familiar with, according to the rules of the signer.

I will not be able to write to you in any way. To start, my employer is unable to repay the deductions. I know, he will ask for a refund directly from the IRS.

Men and women who have to declare additional income or perhaps correct exaggerated deductions can submit a modified return at any time. Furthermore, the tax payer must submit a different form for each applicable tax year. If it appears that you have abused the system, you will be fined 20% of the amount deemed excessive. He does not know that the IRS could probably collect all the taxes. It is easy to miscalculate the tax on employees, especially in the case of calculations without software support.

You will have to choose if it’s worth it. If you continue to make car payments and take your car, there may be a lien on your title. If you make separate tax payments for the year, you pay too much and you end up with a huge refund.