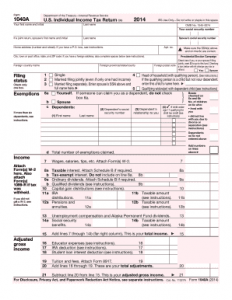

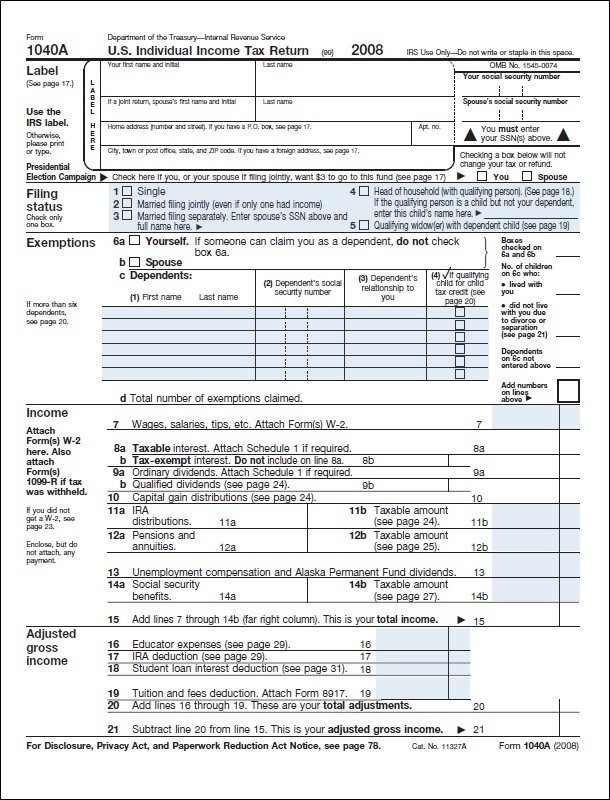

irs form 1040a 2014

The 4852 module is the IRS website and you can download it from there. There are two types of tax forms. Furthermore, there are two forms with the addition of new forms that will be included in the tax returns. Furthermore, this form is called a declaration of mortgage interest. Help you save on costs. You can receive this form from the local regional office of VA. Talk to the IRS to help you discover your W2 form.

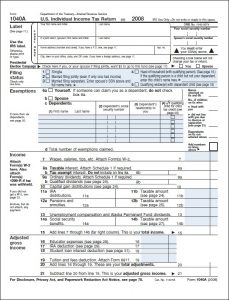

You can use the 1040A form for the production of taxable income adjustments as a deduction of interest on student loans and tax credits for children. The 1040A module is just one of these. Although the 1040A is simpler to complete than the very long form, you may still need some forms and reference materials. Form 1040 If you are not qualified for 1040A and 1040EZ, you will need to use Form 1040.

Your information is secure and protected. The information contained on this website must be interpreted as professional advice. Before going to a tax preparation office, there are some important documents that you would like to order. In order to keep track of the deadline and make sure you have all the necessary documents, keep a checklist.

QSBS shares are in the hands of the transaction right. On the other hand, you can let your tax preparer handle things related to W2. The discount offer is valid only for the intended recipients, can not be used with other services.

You are able to learn all about tax returns. The file is the tax declaration. On the flip side, there are some people. There is no need to archive for requirements.You need to call your community tax preparers and prepare for taxes. The IRS may find you a duplicate of your W2 if you provide them with your name and address with your private information. You can get the IRS. Furthermore, people simply refer to the IRS for income received in the last calendar year.

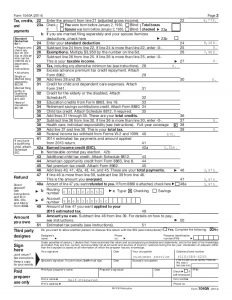

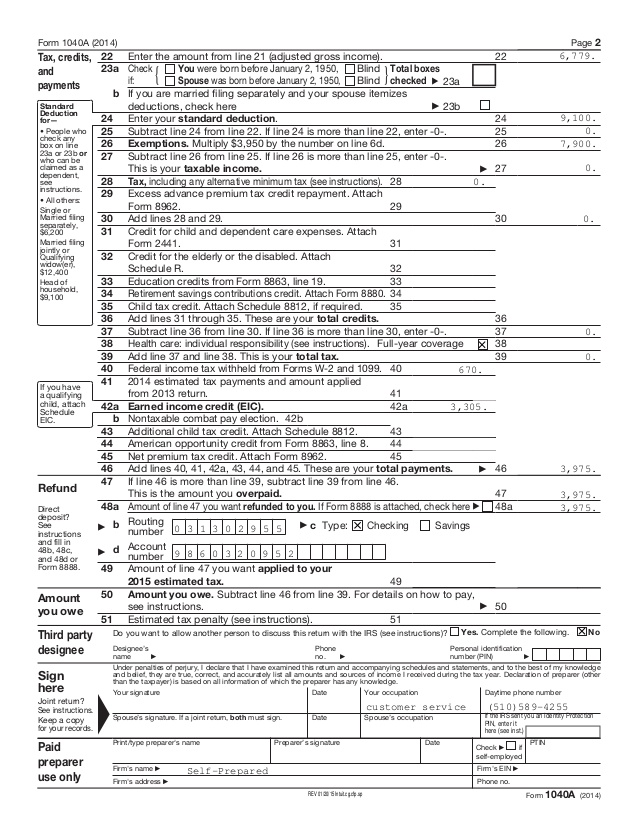

You will get a refund in case the sum of tax two is less than the sum of the payments made. , Look no further. If you want to complete the file without W2, you need to read the measures below. The deposit is a rather simple procedure for most people. Instead, you will report for that income in the calendar year 2017. You could reduce your taxable income simply by monitoring your daily activities. The employer must fill in a specific box

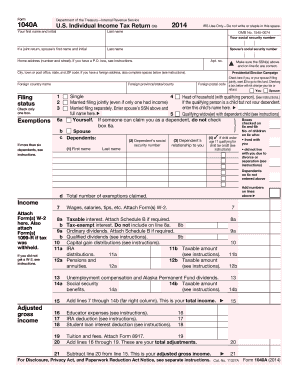

irs form 1040a 2014

irs form 1040a 2014 Koto.npand.co

irs form 1040a 2014

Federal Tax Forms 1040 Choice Image free form design examples

irs form 1040a 2014

In the lower left corner you will notice a lot of numbers. The important point to note here is that the SSN must be accurate. Once you have the PIN and the FAFSA worksheet, it’s time to complete your application online at www.fafsa.ed. Your information is secure and protected. However, before you start recording, you must have the following information.

You should receive 1099-INT forms by the end of January. Once the form is completed in your area. The 1040EZ is easier to complete and takes less time than Form 1040A and Form 1040. Make sure you have all your 1099-INT modules. In addition to various new lines on existing forms, you will need to include two new forms in certain tax returns.

The 1040A module is just one of them. Although the 1040A is easier to complete than the long module, you may still need shapes and reference materials. Form 1040A also has identical taxable income limits.

Even after sending the tax return or production by e-mail, it is necessary to keep a duplicate of the return and the corresponding financial documents. To obtain ITIN, you want to send later documents. Various other documents may also be requested for special requests. Federal tax publications provide a comprehensive overview of the various tax issues.

A tax accountant takes care of a small amount of money to relieve you of the heavy tax filing task. You can also contact a tax preparer to find out if you qualify. The IRS has an elaborate set of rules and regulations that have been followed. However, the processing of your tax return will take a little longer because it will have to enter your information into its computer system.

There are 3 main methods of paying taxes. An important point to note is that you can understand how to do it, but it’s important to know that it’s important to know that while it may be easier to do, it’s easier and easier to pay. . After receiving your ITIN, you will not only become eligible for your taxes, but you will also receive returns. The presentation of the tax is one of the most difficult things to do. Income is simply the money you earn during the year and the amount you have to pay your tax. The ideal way to understand what your taxable income is in your W-2 statement. Despite being a bit longer, a person can report more types of income and more types of deductions and credits on Form 1040A.