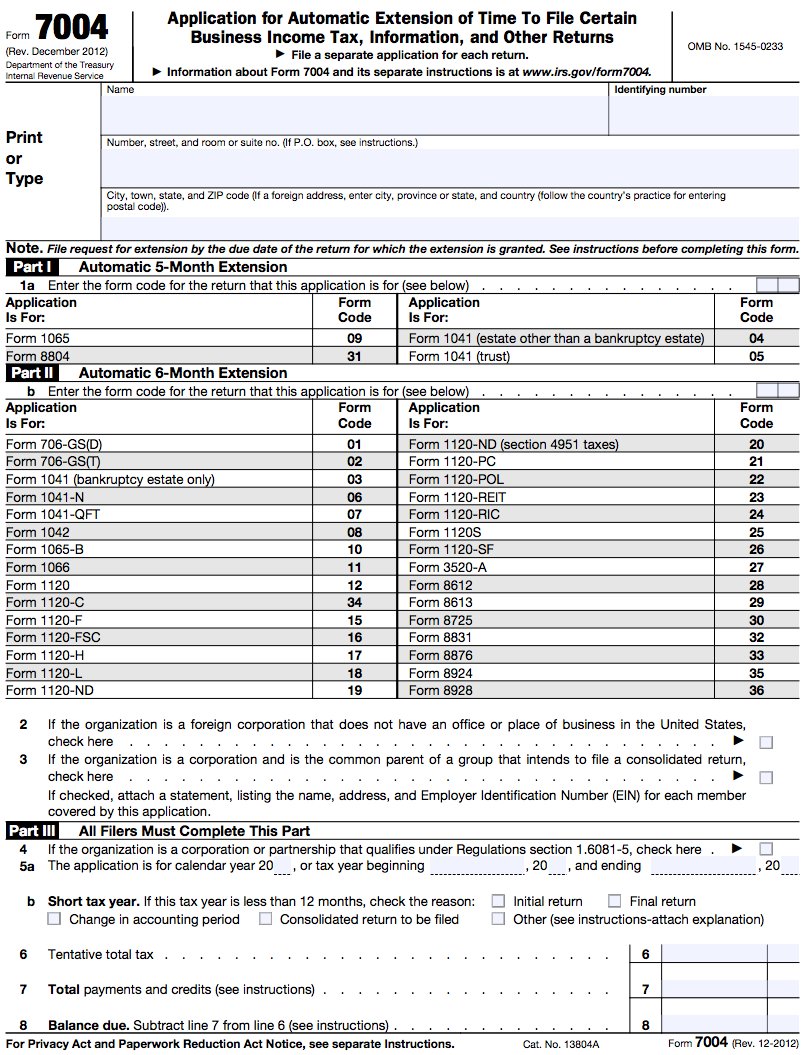

irs form 7004

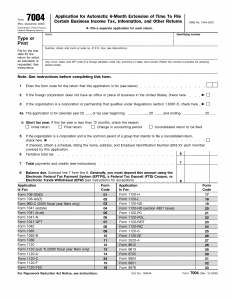

just fill in Form 7004. Form 2688 can be a second extension that you can apply, but it is a little ‘harder to achieve To activate the application for tax extension on the financial statement of income. As a result, the 7004 module must be sent on that date to get a valid extension for 6 months. This form must be signed by someone authorized to represent the company in this matter. You don’t need to send a 7004 tax form if you take a 3-month tax extension.

Module 4868 can be the first type of extension option that you can use. Although the module has 8 unique parts, not all sections apply to each contributor. It’s easy to fill it out, just by listing your name, address and social security number.

Form 7004 applies to various companies. You don’t need to appear for this 2 month extension. To be a little cheaper, you can go online and download the form first.

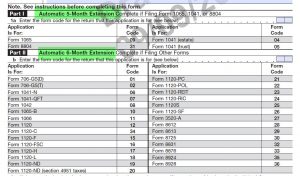

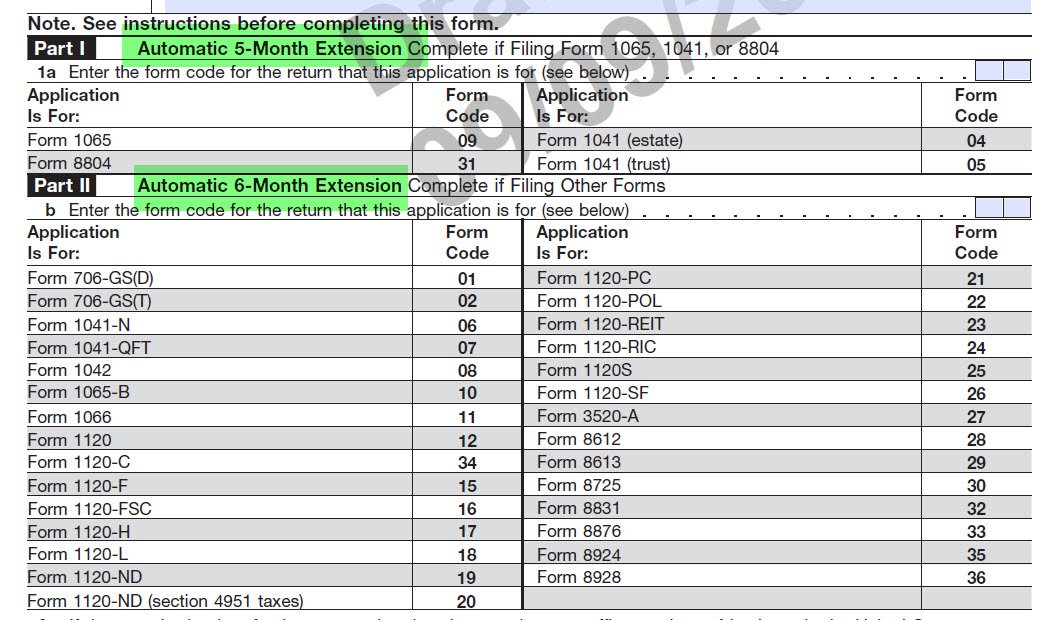

Depending on the activity you have, you can request an extension of time to present your company’s income tax. It’s not very well known that you can create an application for an IRS extension to archive. Extension of IRS storage can be very helpful once you do not have the ability to pay IRS taxes. While completing Part III is mandatory for all, Part I and Part II must be completed based on the type of commercial return requested for renewal. An extension of your IRS deposit will be refused, even though there is assistance from a federal tax refund, and you will be instructed to pay IRS tax on time. The company extension is believed to be automatic, as long as form 7004 is completed and properly archived. If you plan to send a tax extension to your business, it is important for you to understand the IRS regulations and expiration dates.

In the event that the company S calendar year must pay taxes for 2016, you must pay interest on the volume that you cannot pay on March 15, 2016. Companies that cannot afford to file their taxes at the time can present an extension.

Today you can return to the important thing, manage your organization! If you are an entrepreneur or you are a business owner, you must look for tax provisions throughout the year.

Taxation is a significant business module for any vendor, regardless of size and domain. If you cannot submit taxes on time, you can request an extension. Customs are often included in the purchase price of goods. Your new tax deadline will be offered by the IRS. If you also need state taxes and cannot deliver on time, you will want to speak with Land Revenue in your state to understand how to receive an extension of state tax.

There are several strategies to get payments through your own tax extension that uses the FileLater system. If you pay online, you don’t need to send it in the extension request form. Payment of the total amount of tax that is reasonably estimated must be sent along with this request. Although there is no need to pay taxes with your extension request, it is highly recommended if you want to avoid late fees and penalties. Make sure you can discuss how you will make payments to pay all outstanding balances. See module specific instructions for rules about how your company tax payments should be made.

irs form 7004

Form 7004 | robergtaxsolutions.com

irs form 7004

Irs Tax Extension Form Online 3 11 212 Applications For Of Time To

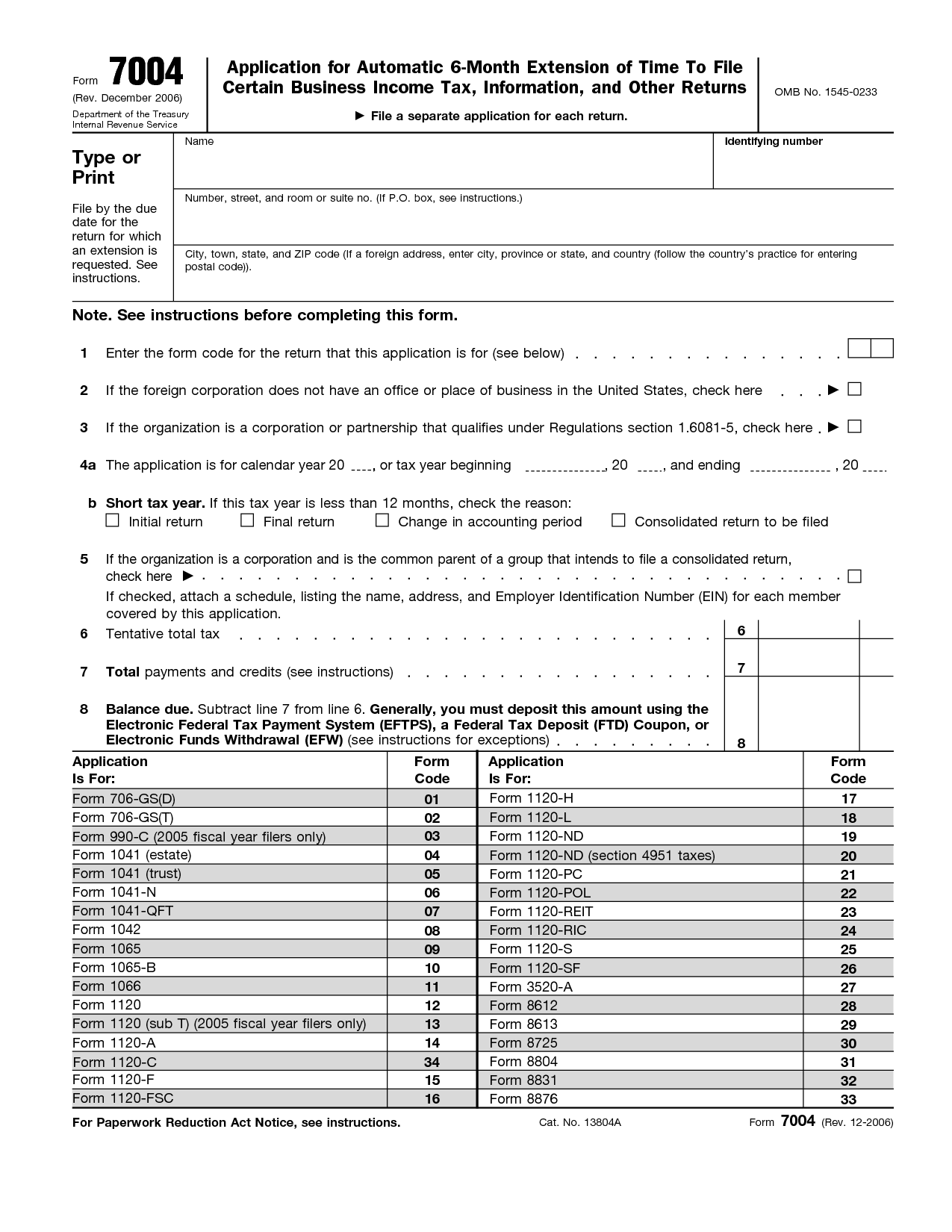

irs form 7004

You can request an extension. Taxes are not deducted from your pay check through an employer. If you also have to pay taxes, you may not be able to speak at any time. Rather, taxes are limited every year. The tax is covered by the partnership even if no distribution has been created. Your new two-date fee will be offered by the IRS. Generally, include the excise tax in the cost of the item.

Consequently, form 7004 must be sent by date in order to obtain a valid 6 month extension. Tax form 7004 if you take this 3-month tax extension.

The 1096 form is not sent if the 1099-MISC form is filed electronically. The form must be submitted online. Although it has 8 different sections, not all of them. It is not necessary to send the 7004 form for this 2 month extension. Surprisingly, there is no particular way to revoke the status of S-corp.

If you are looking for a PDF form filler with a very simple interface, with a simple design and something that allows you to take a look at the software. The filers of some forms of small business income tax require the 7004 form if they wish to submit an extension. Revocation can specify a date of revocation after the revocation date. There are hundreds of ideas and inspiration for swizzlesteve.com. BONUSES for quick and useful answers are very much appreciated. If you use TurboTax

Account registration will reveal taxes and payments every year. The organized financial records and small accounting forms will allow you to report your taxes. 1099-C was issued, which may be useful to show that the 1099-C issue occurred in an incorrect fiscal year.

Your IRS file extension will be refused, despite assistance from the federal government, and you will have to pay IRS fees on time. There is no ranking extension. An IRS file extension can be of great help

Send Appendix C if you are a self-employed person. It looks like a figure out of the value of a lot of money. A form of 706 is to choose portability. Assessments of real estate, businesses and other assets can be extremely expensive and tax-free. In summer, we hired a nationally recognized valuation company to define the value of the stock on that date.