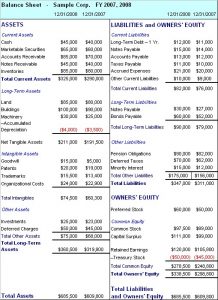

llc balance sheet example

You want a budget to specifically understand what is right for your company. You may also want to cover your budget. The financial statements inform the owner of the organization’s website at a given time. Financial Report This is a financial report that has a commonly used format. You can find our sample balance at the end of the post.

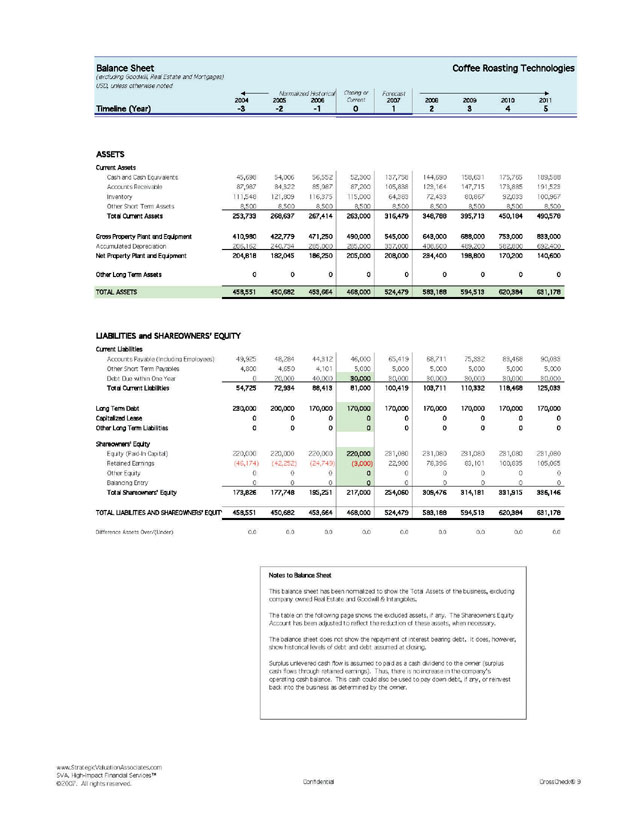

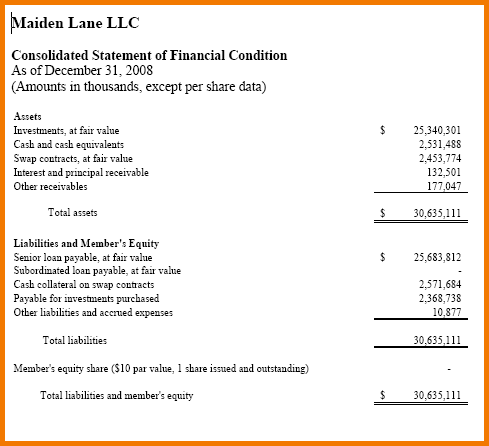

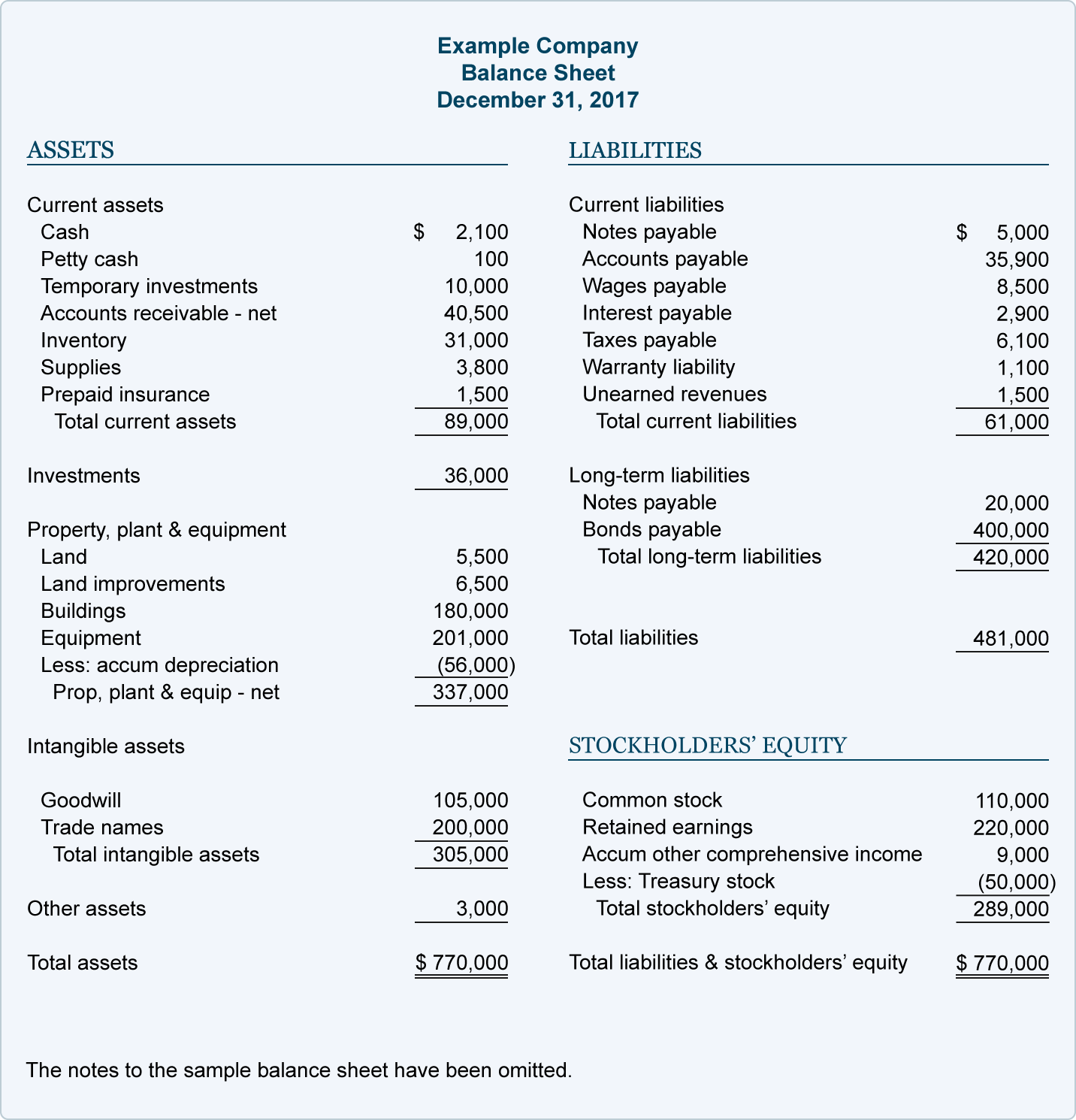

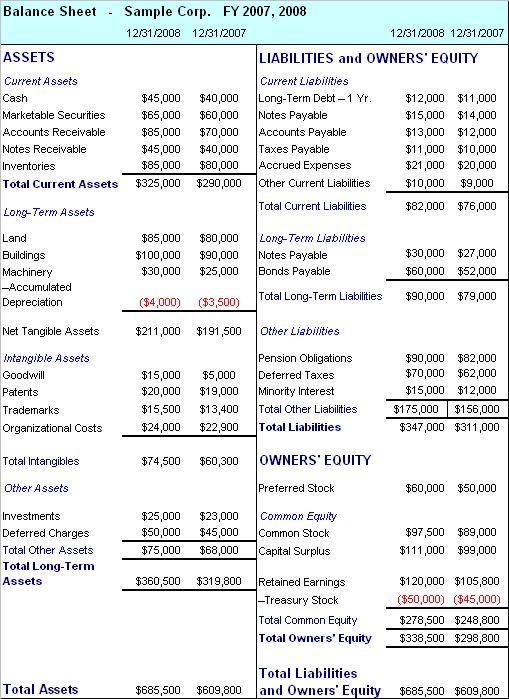

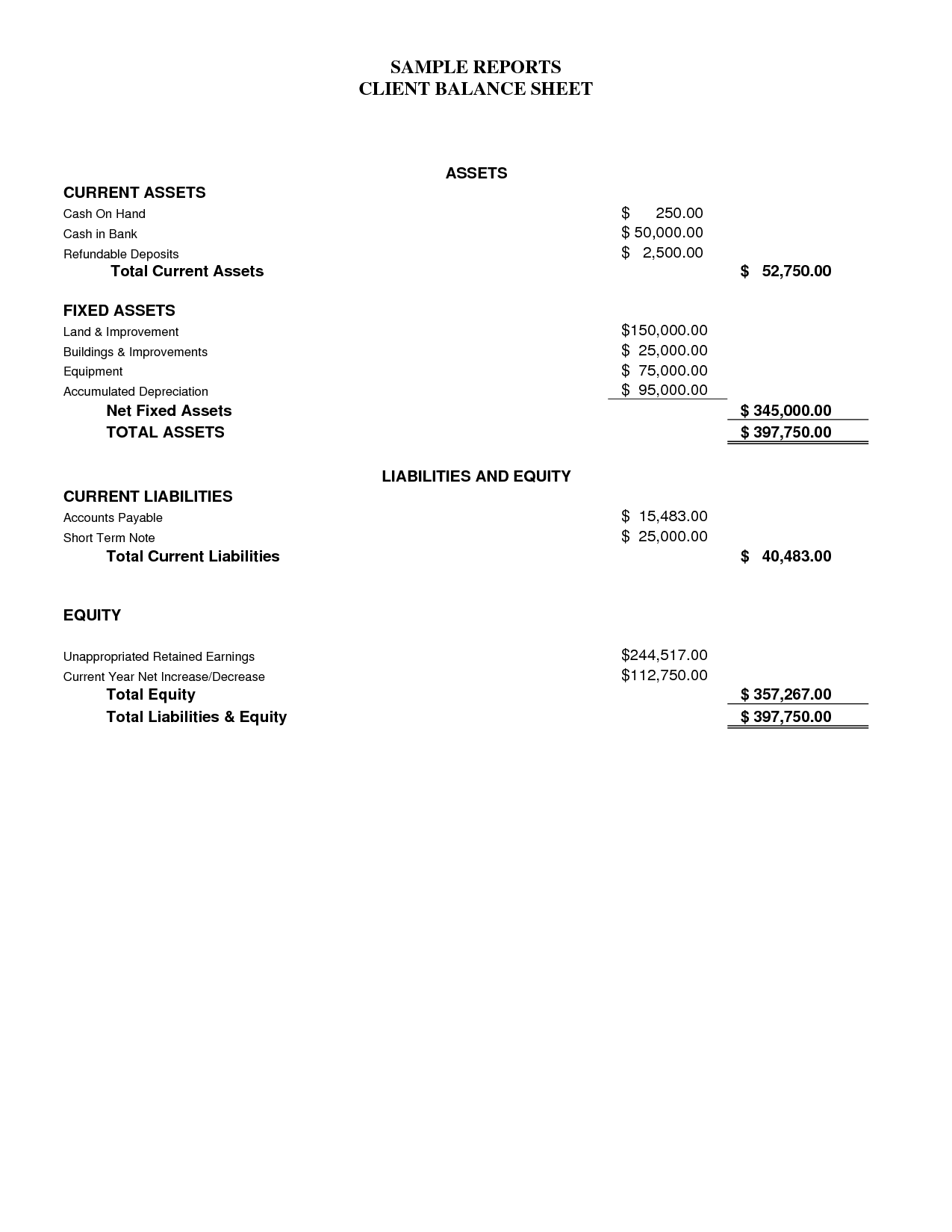

Budgets are a very useful tool for all users to quickly get concepts on how companies do. Another small-scale trade balance. The financial balance is basically an overview of company resources, debt and property on certain days. This is used to obtain information on the company’s financial strength. So make a budget, you have to make sure the balance. The budget must be balanced. The balance sheet, together with income and cash flow statements, is an important tool for owners but also for investors, as it is used to obtain information on their commercial and financial transactions.

Not smooth if intended to be used for at least 1 year. This is something that can be converted into monetary value. This is something valuable that your business has and can be converted into money. It is conceivable that you can use your small business, including buildings, machinery and equipment. The activities, on the other hand, represent the use of corporate funds. If the amount of assets exceeds the value of the liability, the closure of the company is relatively easy.

Revenue reports show how money flows through organizations over a period of time. Some income reports combine both numbers. The income statement is one of the most important corporate financial statements. This tells you if your business is profitable and if not, why not. A declaration of the period. Use an income statement to keep track of your income and expenses.

The company therefore takes on additional debt to finance additional activities. So he made the investment he made. In other words, it seems that it will not be distributed in the future.

Regardless of your size or the duration of your intervention, it is very important for accounting. If a company has many partners, each partner gets his drawing account. If your company has a financial loan, any institution will become a complete set of financial statements to be able to process your loan application. Each company has customers who will not cover the goods or services provided by the company.

llc balance sheet example

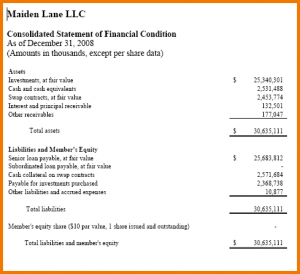

Llc balance sheet | Authorization Letter Pdf

llc balance sheet example

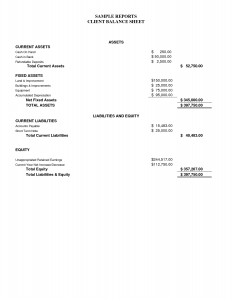

Sample Balance Sheet Template for Excel

llc balance sheet example

Accountants have long used balances to indicate a company’s financial health. A balance must be balanced. It could also serve as an indicator before a disaster occurs in the company. Secondly, your budget shows how those who want to do business will understand your business. The financial balance allows you to know the current value of your activities and the complete vision of your organization. A simple report provides a complete picture of an organization’s financial health at any given time.

Current statements are a bit more complex and contain more information, but basically follow the same structure. When you recognize how such a statement is made, it will be much easier to create your own statement in the future. A good track record will help potential lenders determine the creditworthiness of a new client and help potential partners decide whether to invest or not.

LLC is kind of a legal entity. If the LLC has multiple owners, the share of each operator depends on an agreement, usually a formal operating agreement. Instead, choose the type of entity that your LLC will emulate.

It is interesting to note that the liabilities are extremely liquid. Other forms of liabilities are long-term. The way you configure your existing liabilities and the number of individual accounts you establish depends on how accurately you want to monitor all types of liabilities. Long-term liabilities go beyond the current calendar year. Short-term liabilities are those due in the year.

For some companies, the book value is extremely informative about the financial position of the company. In the case of an active asset, the industrial value of the company’s shares has no essential link with the nominal value or the declared value. It will probably not be equal to the total market value of all outstanding shares.

If you think it is better to run an activity based on your current account, you absolutely have to come back and learn the essential aspects of business accounting if you don’t need to be deceived. false details! Without capitalization, your company may not really seem to be separated from you, personally. If the company has many partners, each partner gets their own design account.

To determine the purchase price and finance it with adequate insurance, it is essential to understand the value of the company. Not all small businesses will complete each step. While the established business will probably already have its own rating, it is often much more difficult to accurately determine the success or reliability of the new start-up business.

The first step in the accounting of an LLC is to determine how your LLCs will be treated for tax purposes. Of course, it is not a question of measuring the real value of the owners’ own funds. Although the basic accounting of an LLC can be quite simple, getting the help of a tax specialist is usually a good idea.