sample letter to collection agency

You must underline in what letters are successful in the passport authorized by the documents you provide. The authority must be very precise and must not leave room for ambiguity. always write lines. Point out that the letter must be ignored if important actions are taken at the end of the letter. A cover letter is a good example. If you choose to submit only a pre-qualification letter with your offer, simply specify in your offer letter that you will send a pre-approval letter, once possible. Below, you will find our welcome letter. Although it may seem like a normal small business letter, the letters of authority have great legal significance.

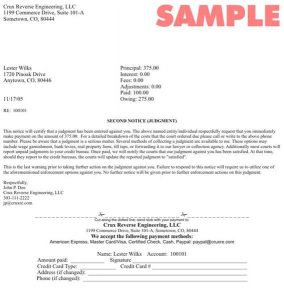

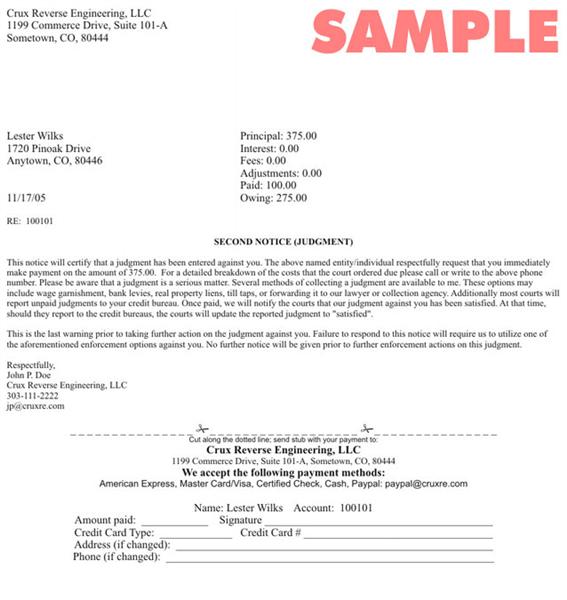

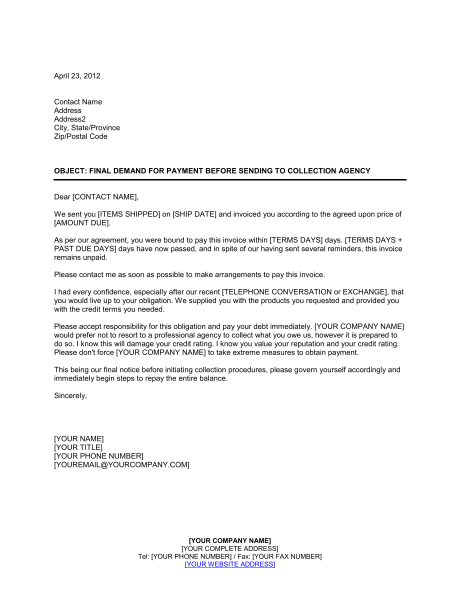

Determine what type of debt it is. In the letter you have to manage the debt that you convey. If you are not even sure what the debt is, you can ask for the name of the original creditor. If you can prove that the debt is older than the recipe, then you don’t have to pay it. Negotiating credit card debt is just one tool that you can use to start an approach.

All you need is all the basic information of the worker. If you know how to change your credit report, you will want to receive a report. An important point to consider is that information can be obtained from credit score files. With only a few large photos, lots of patience and motivation, an individual can get various interesting details about how to deal with their collection agents and their Scoundrel collectors.

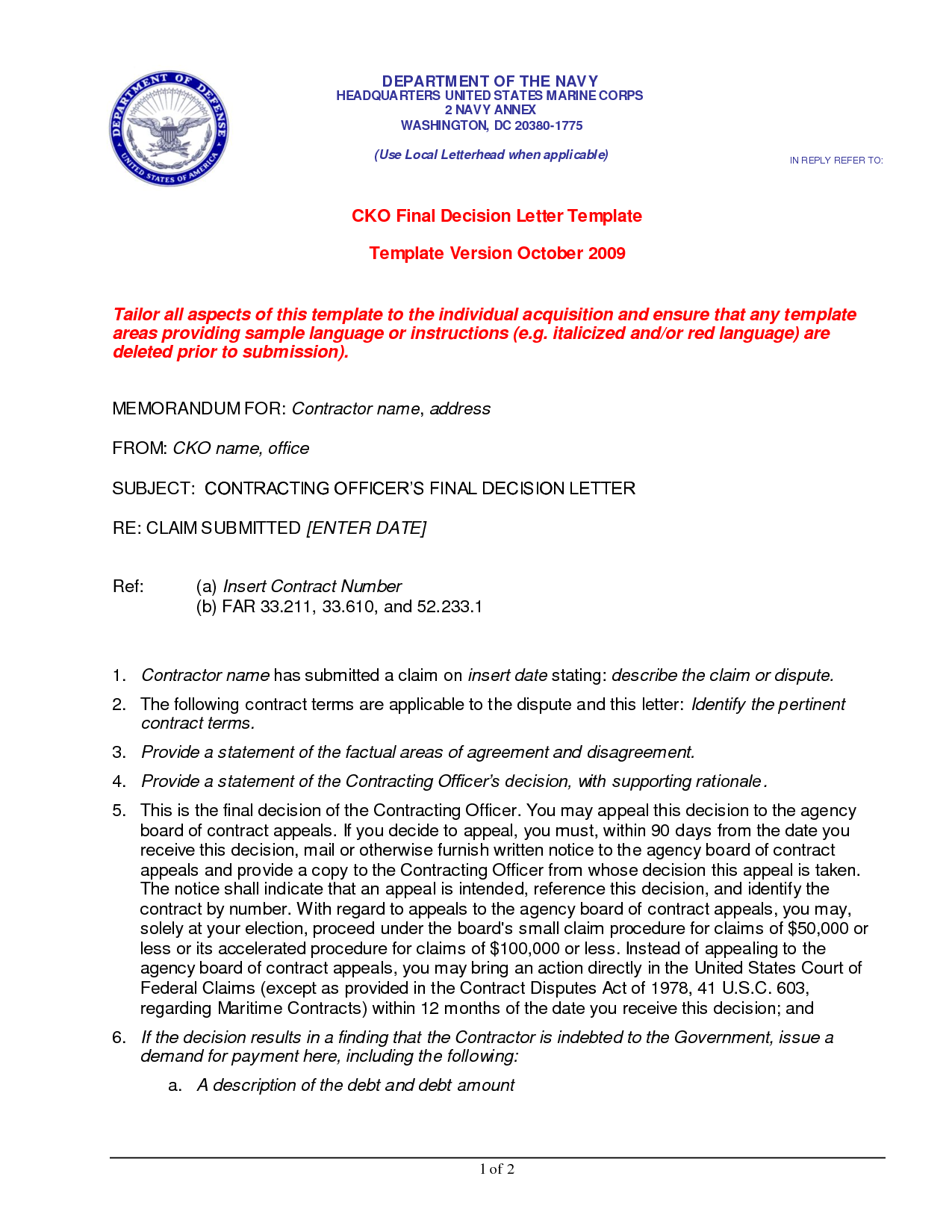

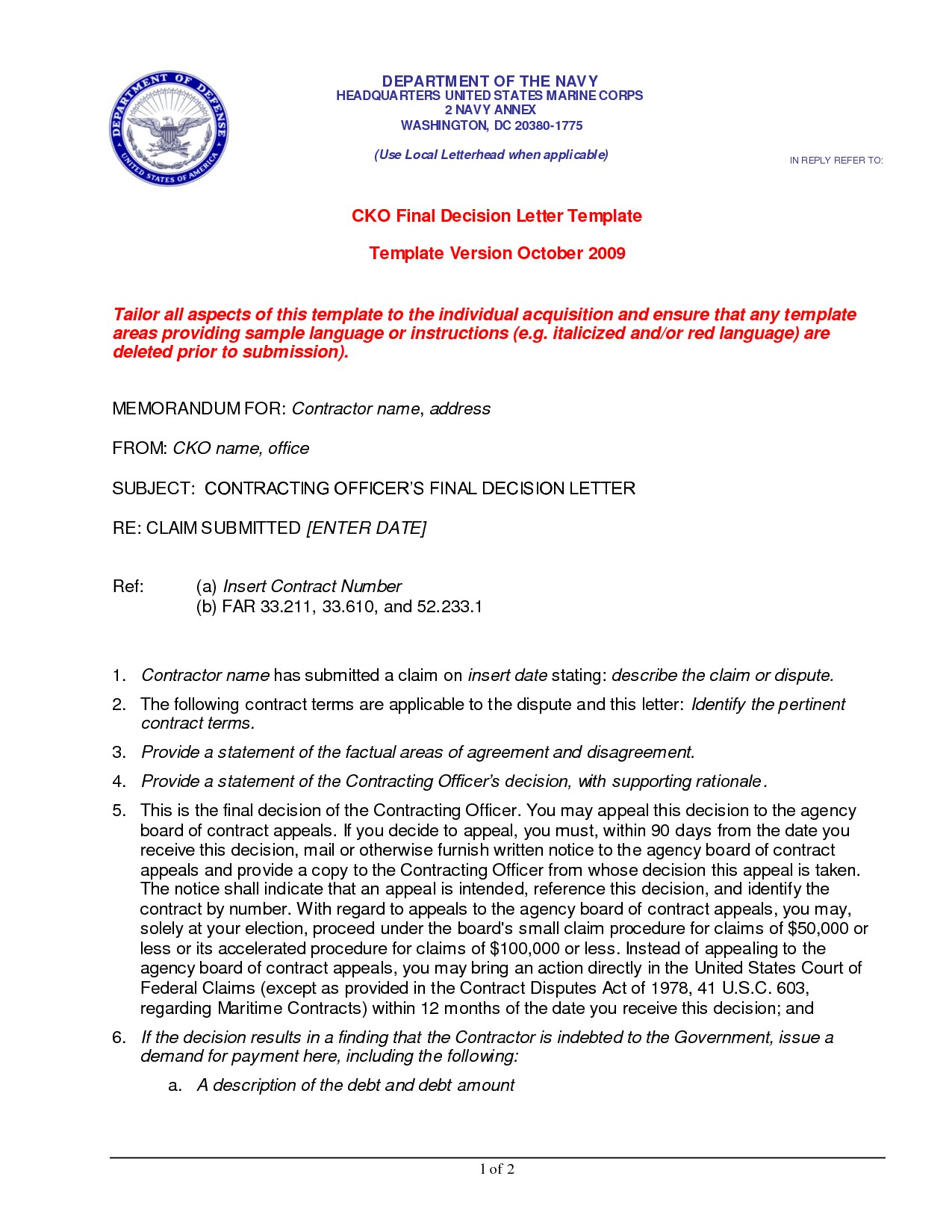

The letter must be printed on the letterhead organization. Your letter must reflect that you are serious and want to pay all costs once possible. It is very important that you first compile a letter and you connect with someone who has previously done the work of a passport, who will be able to help you with the process.

Make sure you write the letter in the most professional way. Standard letters are generally not accepted for situations where the consultant hopes to receive certain actions. Unfortunately conventional letters used are very likely to be rejected. Normal letters that require cancellation are not appropriate.A power of attorney is required to authorize someone to conduct legal, business, medical and other transactions to your advantage. An authorization letter is an important document and you must ensure that it is a document with strict words that should not be negotiated or misunderstood in any way. By law, a debt validation letter is not available when you are still handling the original company as a bank or credit card company. This is only the letter you sent to your collection. Credit score for rejection letters can be sent from one party to another during the organization to inform the recipient that the credit application has been refused.

sample letter to collection agency

Index of /cdn/8/2007/709

sample letter to collection agency

Writing letter to collection agency

sample letter to collection agency

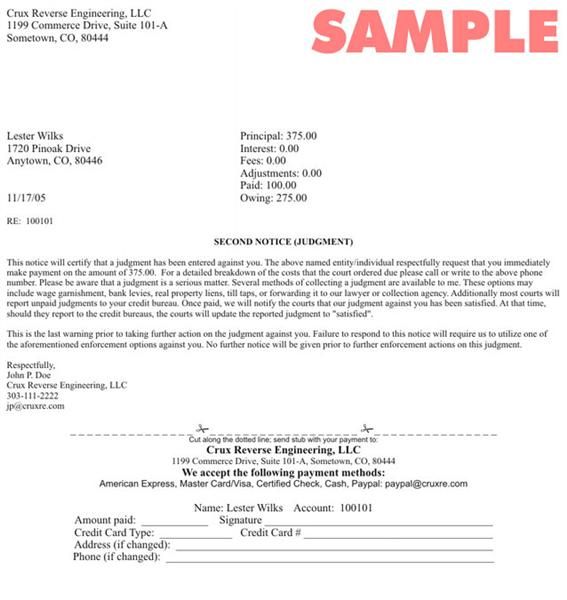

The three credit bureaus explain how to eliminate incorrect information from the credit score report. In addition, collection agencies must stop contacting you as soon as they know they are represented by an agent. You have to explain why the debt collection agency is unable to work. Contact the consumer protection agency to find out what is allowed in your place of residence.

Late payments on credit cards or other loans can have a widespread financial impact. Payments vary based on the amount of credit used during a given period. When setting up a payment program, you may need to earn around 10% of the total amount and prove that you need to create subsequent payments.

Determine what kind of debt it is. Check all the details and the debt shouldn’t be clear, ask for more information. I know you have to change the avalanche from month to month to reflect this. If you can prove that the debt is before the prescription date, you will not have to pay it. You can incur a medical debt in many ways.

A number of mortgages may be subject to legal interest rates and origin taxes. Receive new copies of 3 credit reports a month or two later to check. Payday loans is a short term credit source from Toronto Canada that should be used.

Call your doctor immediately if you think your account is incorrect. If you receive an invoice that you cannot afford, go to the tax assistance center or hospital billing center as soon as possible. There are many bills and they come from different departments of the same hospital! If you have several bills a month, one or two cards may be more feasible.

The most common case of open credit is a credit card. Furthermore, many credit accounts have been inactive for over seven decades. In some states, you need to include items such as a credit card number, an expiration date, and a line that reads them, minus the charges allowed in your state.

In a few weeks, look for the information above by mail and contact everyone if you have never heard of it. Make sure you get the information you are looking for. It is essential to find information on the phone number before acting. The important point to consider is that no one can have accurate information removed from the credit score file. You could think about it, but be extremely careful.

Letters of credit can help you repair your credit. The only thing you can do to compose a letter. Our letter examples provide a basic model that you can use.

The collector does not break the law. What do you know about the treatment of debt collectors. A debt collector can always request the voluntary payment of an old debt while the law cannot make you pay.