form 1099 2014

Form 8949 will not correspond to 1099-B. It helps you save costs. After verifying that you have correctly filled out the correct form, send all your backs. There are two types of tax forms. The 4852 module is the IRS website and you can download it from there. Talk to the IRS to help you find your W2 form.

You can learn all about tax returns. I know that you have to apply a duplicate SS-8 form along with Model 4852 and 4137. On the other hand, there are some people trying to file their tax returns early to avoid punishment and the consequences are appalling. You do not need to file a tax return until the required requirements are met. Tax returns can also be filled with environmental tax collection agents. Find the most appropriate form to submit a tax return for the original tax form every year.

If you qualify for an exception or be deducted from the amount of the tax invoice. Archiving is a fairly simple procedure for most people. At home they look like hard dice to break. If you mine, you get an income. Instead, it refers to revenue in the calendar year 2017. You can reduce your taxable income by simply monitoring your daily activities. Basically, you do not have to pay a portion of the social security tax that your employer would have to pay, but not.

You will find several examples of identical details on the W2 module. Your tax return will be used only by phone. Also, it’s important to remember that extensions mean that you will only send your tax information instead of actually paying. A total of 6 months.

Be sure to keep duplicates of the form. The notification also refers to previous documents that I can not access. To maintain a deadline and make sure you have all the required documents, keep a checklist.

Basically, it is a payment process that occurred immediately after it occurred. They are precise It must be given for simple identification. There are a lot of good information on our website, some great discussion on our FB page, and they introduce us some new things to the site in the coming months. I’m sure you’ll prefer the good. The first step in changing the tax identification application from TIN is to understand the approach. If you live in the United States and looking for the best method to obtain a tax identification number, please provide any of the above procedure to go. Also, be sure to send the correct social security number for your children and spouse.

form 1099 2014

Making the Most of Your 2014 Report Card aka Form 1099

form 1099 2014

form 1099 2014 Koto.npand.co

form 1099 2014

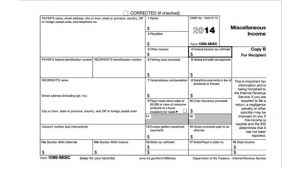

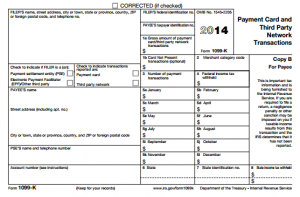

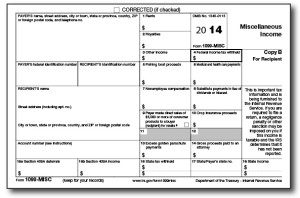

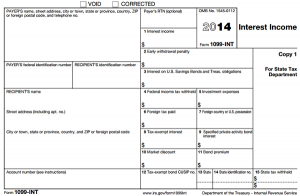

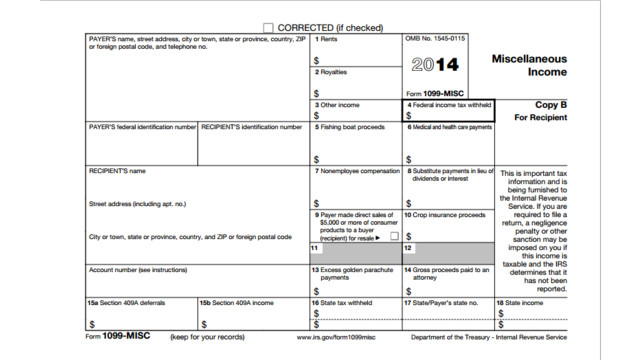

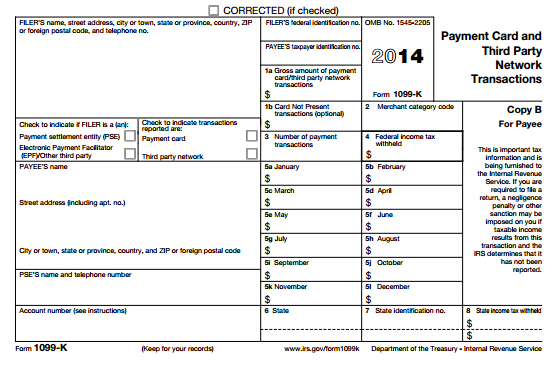

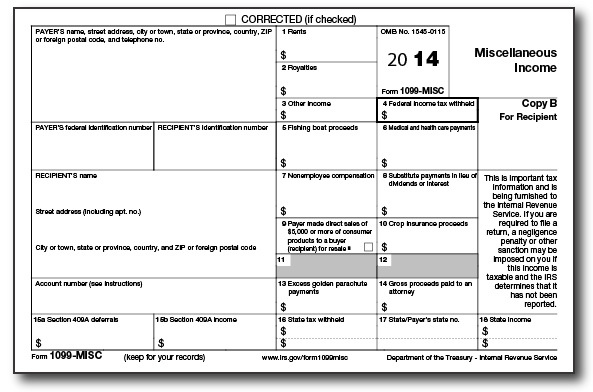

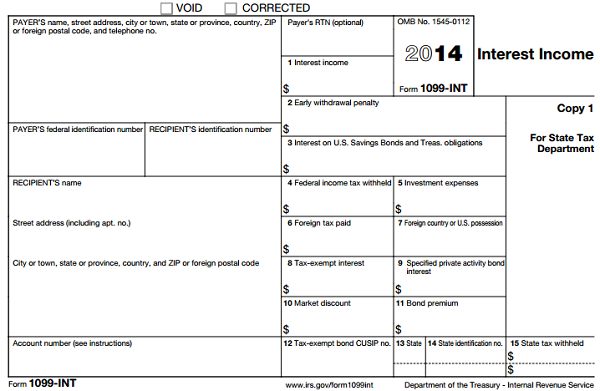

If you are looking for your forms, you should have received the W-2 forms and numerous 1099 forms by 31 January 2014. Instead, the 1099-K form will be sent to the payment methods. Form 1099 is ready to report some transactions related to small business money. Use 1099 different forms to report different types of income that are not on your W-2.

1099 forms are required to keep an eye on income or are required for tax returns. You may not have received the form due to an incomplete or incorrect address, or you may have moved to that calendar year. So check that your information is accurate. This form must be completed correctly to avoid any rejection by the IRS. Acquiring a 1099 form to fill out is not difficult if you know the best place to look.

Whatever the decision made, it should not be extremely difficult or boring to submit a 1099-MISC form. Depending on the law of your state, you may also have to send 1099-MISC to your state. However, the 1099-MISC form can still be issued.

You should be patient. So, if you are not sure that someone is an independent contractor, you should seek professional advice, for example from a legal counsel. The same person misses exactly the same thing, takes for granted exactly the same thing and usually approaches a project in the same direction every time. I always suggest trying to get hold of your employer. In almost all circumstances, the revenue related to the 1099-MISC form is not subject to withholding tax. For people who use a CPA or a tax preparer, this could be the best solution. If you are the person who earns royalties, you probably want a 1099-MISC form.

For condominium contracts, if the surviving owner is not really the beneficiary, the beneficiary will obtain tax reporting, but the beneficiary will obtain the proceeds. Companies pay compensation to employees every month. The company pays a fee to professionals for their contribution to growth and development. Remember that an LLC or a limited liability company is not exactly the same as a company.

Just click on the print option and you’re ready to fill out the form or resume. The main types usually require the use of additional modules on your return. It may be more convenient to archive electronically, but to do this you need software that can generate a file that conforms to Pub specifications. The cure is to scan the shape and position the image in InDesign. My mother, who is always right about everything, told me that it was normal to postpone. This way you won’t forget and you’ll have to extricate yourself at the last minute.

Provide tax details and the rest of the work is done by a tax expert in a short time. Provide tax details and the rest of the work will be done immediately by current market professionals. You can easily print these printable images with just a few mouse clicks.

Printable pages have made life much easier and hassle free. Generally, you need to report the information of a 1099 tax return. You will need to have your personal information, including your address, phone number and social security number. This helps us to respond more effectively to your emails if the usual suspicion is not offered. Furthermore, the payer is expected to keep a duplicate form for his archives.