uber tax forms

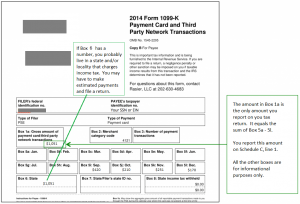

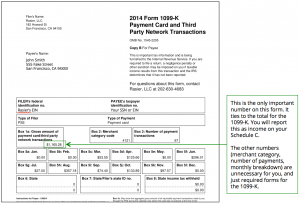

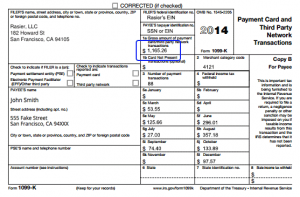

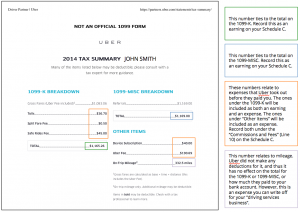

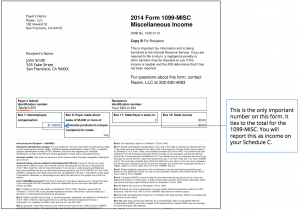

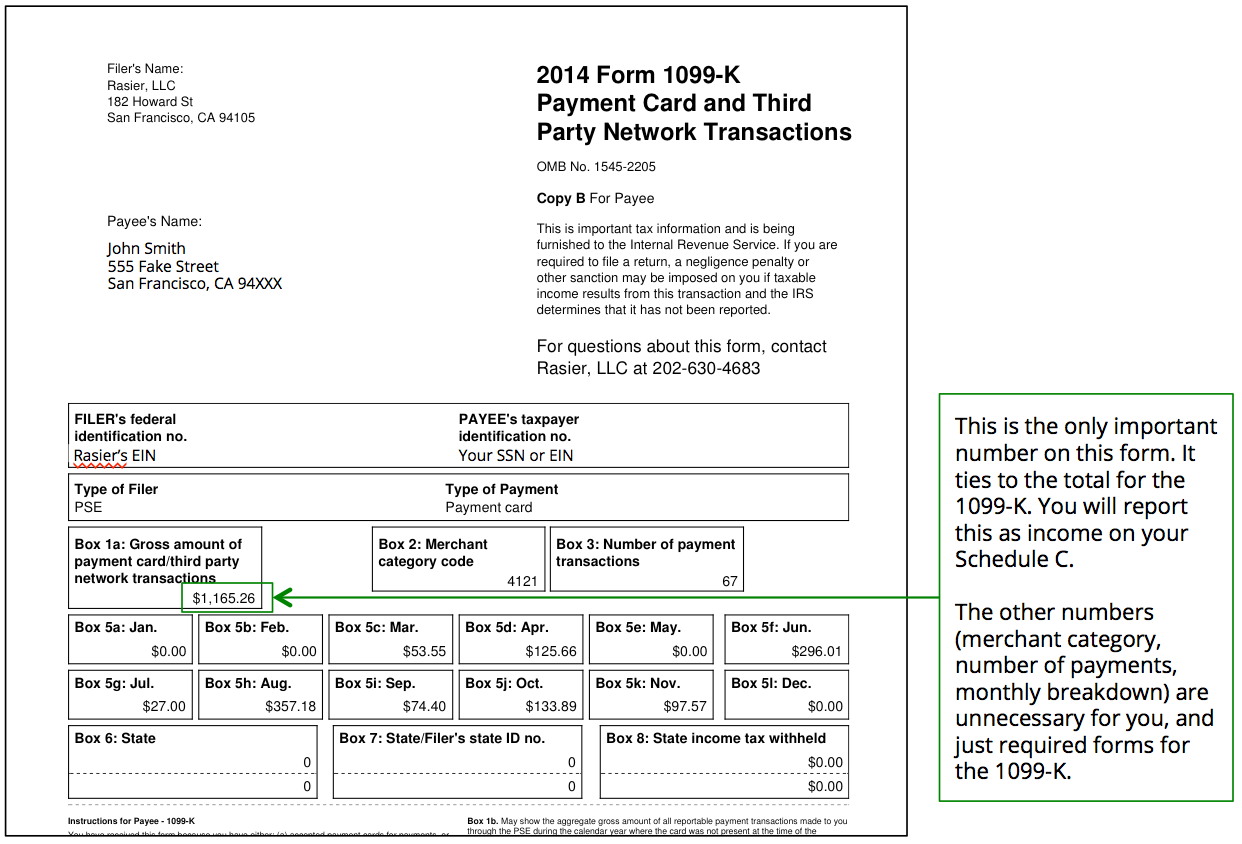

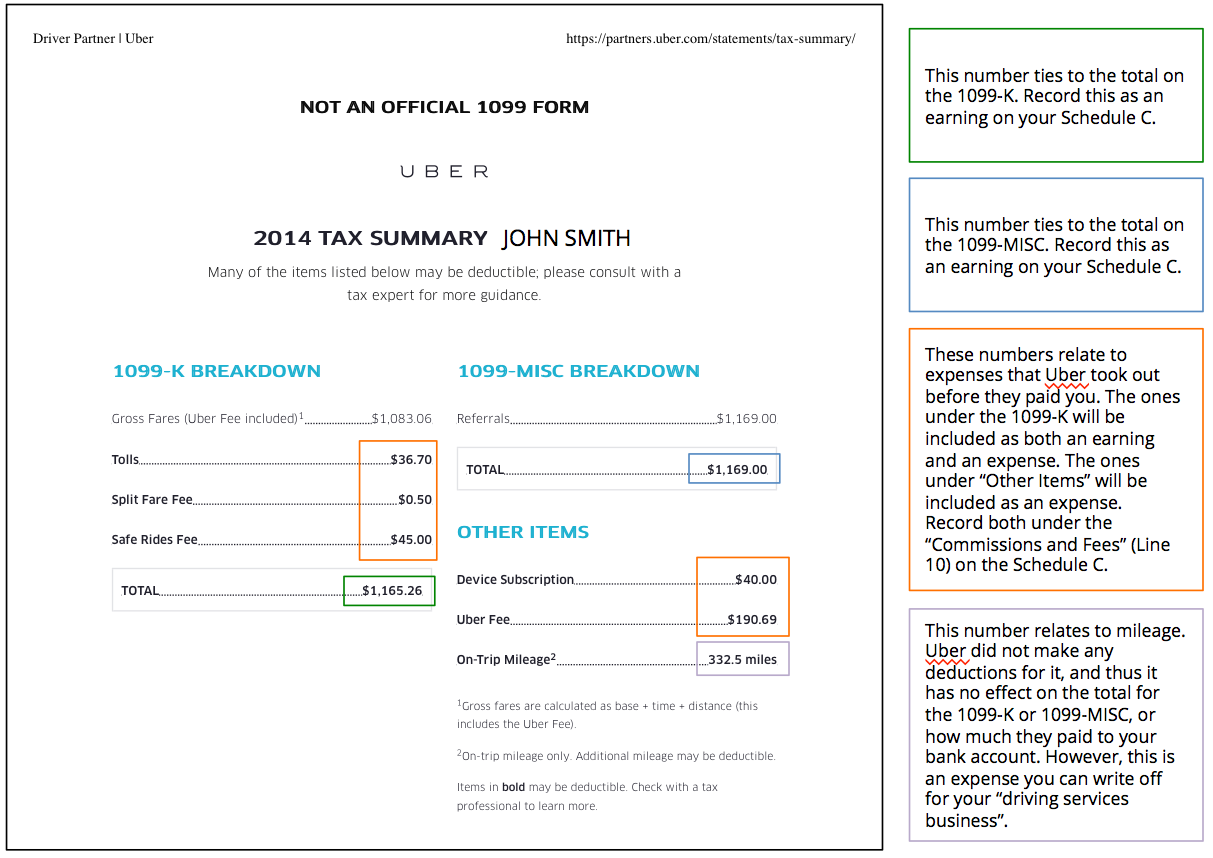

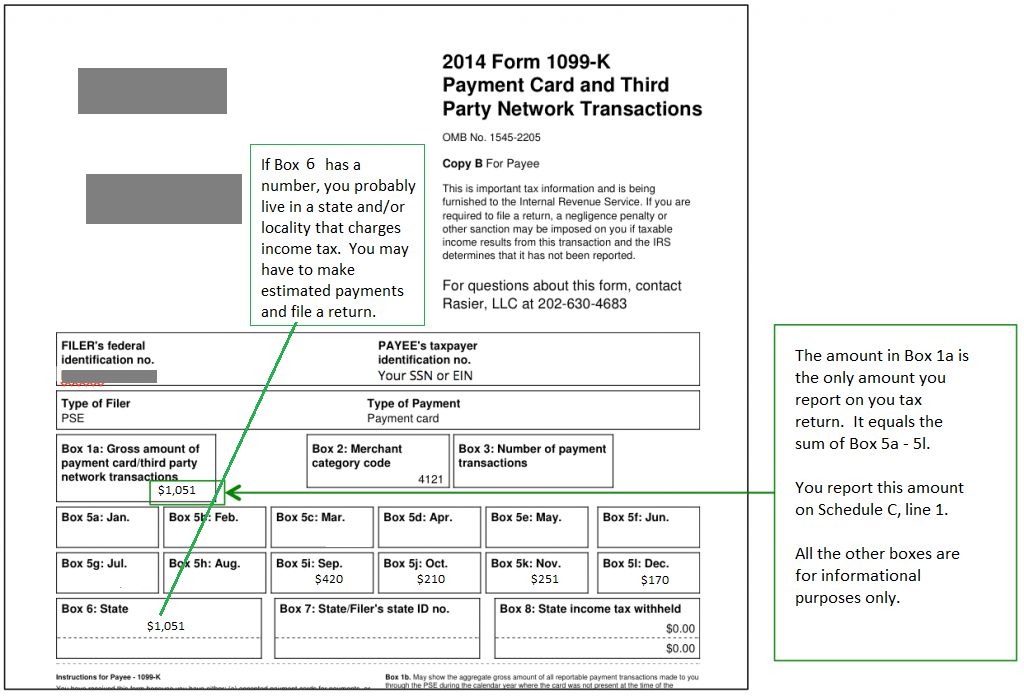

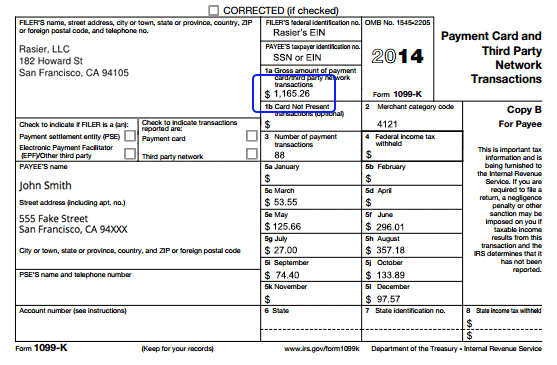

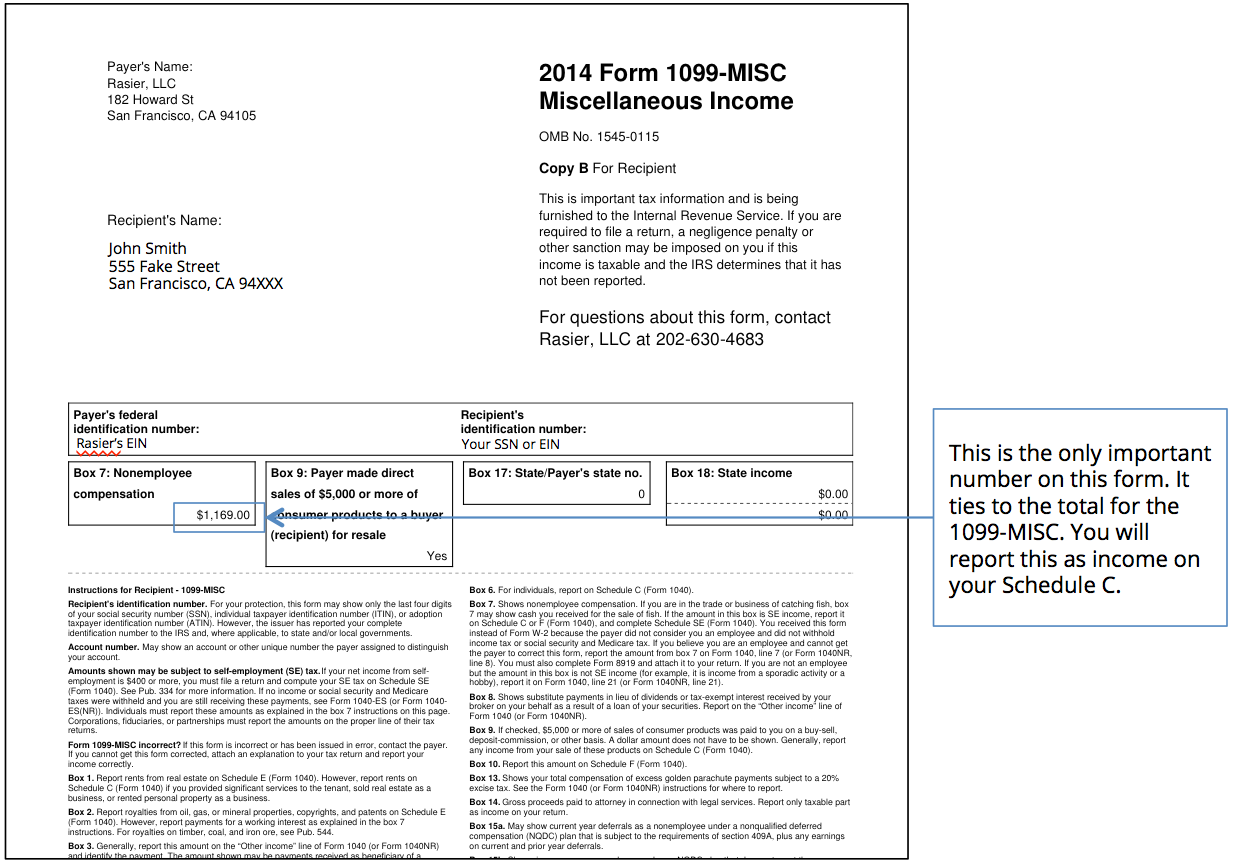

Whatever the reason, after starting driving for Uber, you are set as an independent contractor and you must file a tax return at the end of the year. Uber will provide you with an individual tax report summary that you can use to file your tax return. Uber proposes to prospective drivers as a means of making money on your terms. However, Uber will not send you W-2. In fact, Uber simplifies the reduction of the corresponding amount by offering 1099-K damage on its tax summary page. Uber will contact you to notify you whenever your tax form is available or you can check tax information on the Uber partner website. Uber is just a service that can help you find passengers and facilitate payments.

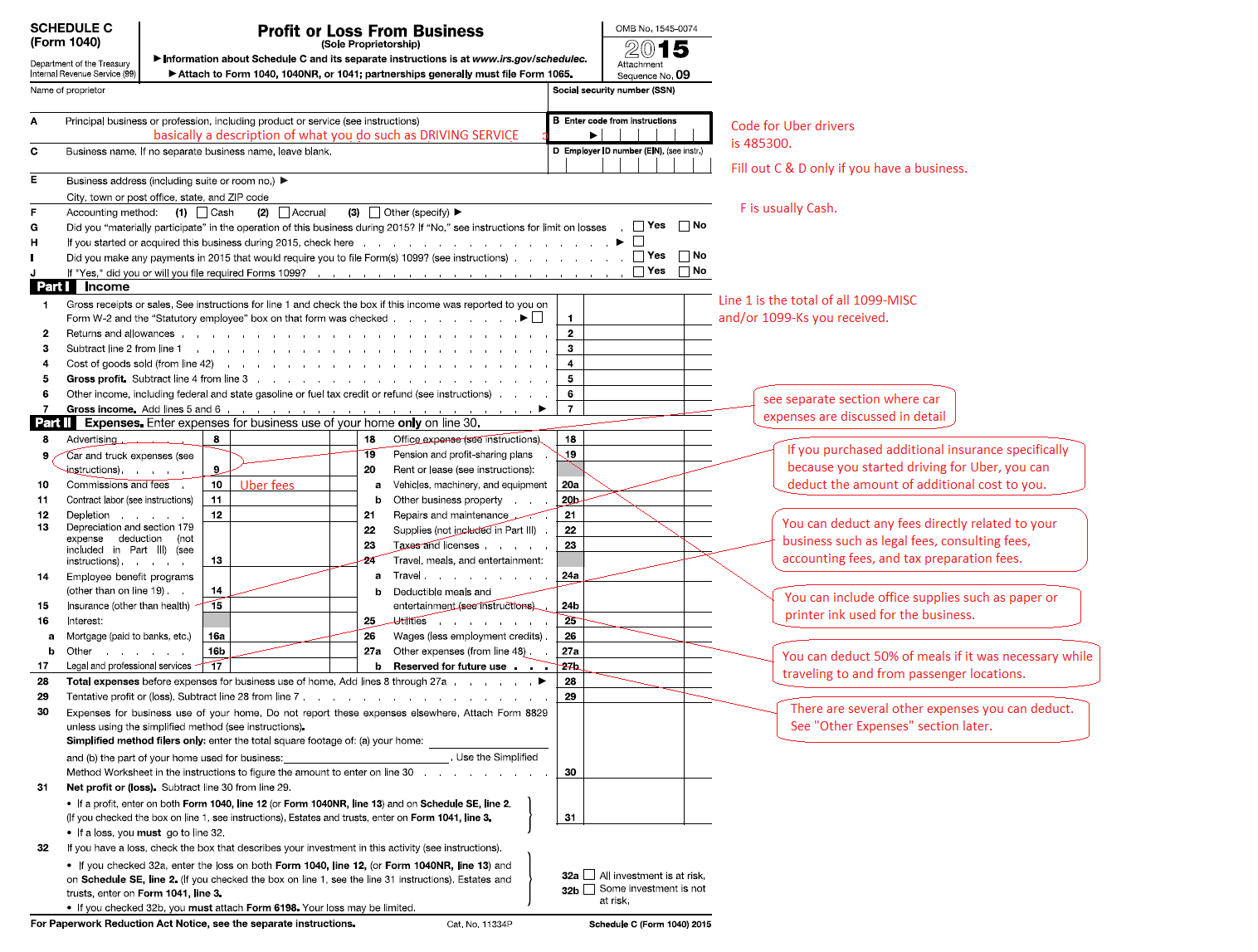

Only fees that apply to commercial use of the vehicle can be reduced. There are many ways to track your organization’s expenses. The biggest business spend is your vehicle, so make sure you have detailed mileage records for each day you drive.

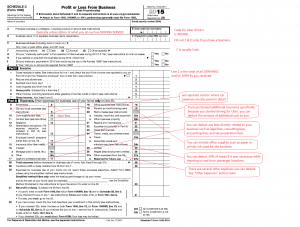

When the mechanism is right for each question, the mechanism is right. Your 1040 annual form is a great guide to how taxes affect your life and what you can and should do to reduce it. Together with the 1040 standard, you may need to complete other tax forms.

If you have a lot of deductions, you will have the opportunity to reduce your income as a driver. Potential reductions can vary depending on how your company is organized. Typical mileage might be your deduction for the driver, but you simply report that you may experience headaches if you receive an audit from the IRS.

For most drivers, it is generally higher than the actual vehicle costs, but there is a possibility that the actual vehicle costs are higher than the standard mileage reduction. Or you can use normal IRS mileage deduction.Even if you don’t receive 1099, you still need to report all the income you get. To be able to estimate the amount of tax, it is also possible to estimate current income but also past income. After determining your net income, you may need to start paying quarterly income tax to avoid very large tax bills and penalties as soon as it is time to send your return. If you create a large income through Uber’s guidance, you may want to look for the services of an accountant.Some costs can be deducted from income. Only a few accounts for bills are as appropriate as described above.

In addition to income sharing plans, you can register all your related expenses. When dealing with business costs that are tax deductible, you must keep a very detailed record.

To start, there is no tax withheld. You must understand how pilots work and use the best method for your personal circumstances. You can talk to a tax professional to know exactly how much you can reduce.You have to pay the tax yourself. Because you can see our taxes as independent contractors, they are many, more complicated than employees, who only accept W2 forms at the end of the year. Archiving costs are simple and not too painful. If it appears like a dice that is difficult to describe, you can always use a professional tax advisor service.

uber tax forms

Tax Help for Uber Drivers: How to File Your Uber 1099

uber tax forms

The Driver’s Friendly Guide To RideShare Taxes In 2015

uber tax forms

Whatever the reason, you have started driving for Uber, you are designated as an independent contractor and you must pay the taxes before the end of the year. Uber will provide you with a separate tax report that you can use. Uber, however, will not send you to W-2. In fact, Uber facilitates the deduction of the necessary amounts by giving a 1099-K breakdown on its tax summary page. Uber is just a service that allows you to find passengers and facilitate payment. Worker Status The first stage of the work process for Uber or Lyft, you do not do it as an employee.

Normally you will need to review all of your company’s activities on Form 1040. In the end, if you run your business from home, for example for TaskRabbit concerts, you may be able to claim a deduction from the home office. You must split your personal and professional expenses using the normal mileage rate. Starting your own business is a rewarding business that also generates a variety of tax complexities.

If you have registered for an Uber, you should learn more about the tax implications and how it is produced. A crucial taxation can be subtracted from income. In addition, they may also be eligible for SEP contributions. Another important tip for Uber drivers is to understand how to understand the expenses of the company. They must remember that their income is taxable and, as such, must take into account all relevant details mentioned above. If you are full-time or part-time, you can earn some money quickly.

The form consists of other forms of payment unrelated to the guide. Your 1040 annual form is an excellent guide on how to affect your life. In addition to the 1040 standard, you may need to complete other tax forms. You must send a form to the IRS for a tax return.

Potential deductions may vary depending on the configuration of your business. The typical mileage deduction will probably be the main deduction for a driver, but you simply need to inform yourself using the IRS. For most drivers, it is possible that your mileage deduction.

Some expenses can be deducted from income. In addition to the earnings of the travel sharing app, you can list all your expenses. Many expenses, such as car cleaning, mobile accounts, passenger fees and the like, can be deducted from dividend income lines.