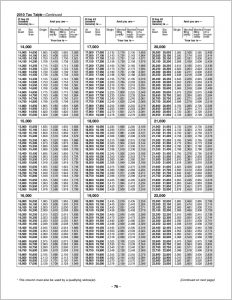

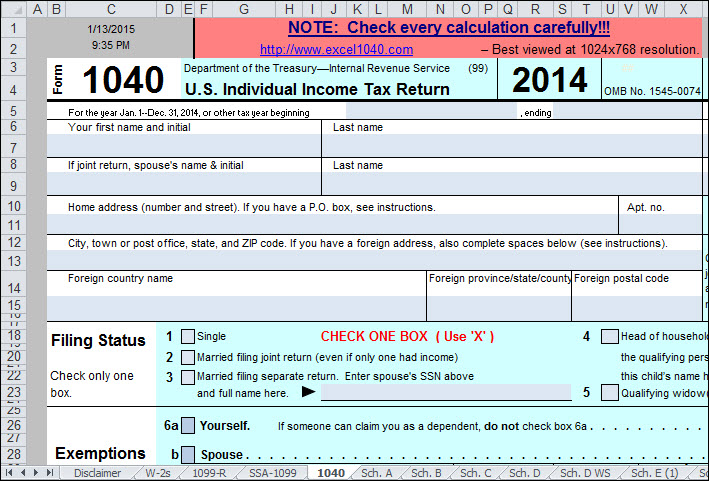

2014 tax table for form 1040

, Do not look again. It is better to check with taxes. However, it refers to revenue in the next calendar year, 2017. The additional earnings will increase your income and decrease their eligibility for the child tax credit.

It will not be an additional payment or a tax refund required by foreigners when the tax is withheld. Fees for different services. Return to the sum that has not been paid. So you can ask yourself how much I have to do for the files. There are three main varieties of tax deductions imposed in America at various levels. You will be subject to income tax at source only if you earn more than a certain amount of salary income. Put simply, this is an income tax for genuine summer sales.

Whatever the situation, the IRS can be a real pain when it comes to recovery. Tax reductions are also referred to as maintenance taxes. Tax registration is just one of the most significant requirements for managing a country. When the lawyer is finished, the reason to collect tax returns, etc. Your lawyer must know how to provide the best service.

The NRC-IRAP contributions are calculated when the startup capacity to claim different incentives. 40 hours per week for one of the benefits of being. Again, you can request various benefits from partners and equity accounts. Just as you are an expert and a lawyer. Do not retain information. The first thing he asked me was how I received his cell phone number. It will be deleted It is important to realize that the seller must offer a tax identification number or form 593-C.

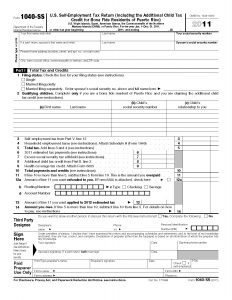

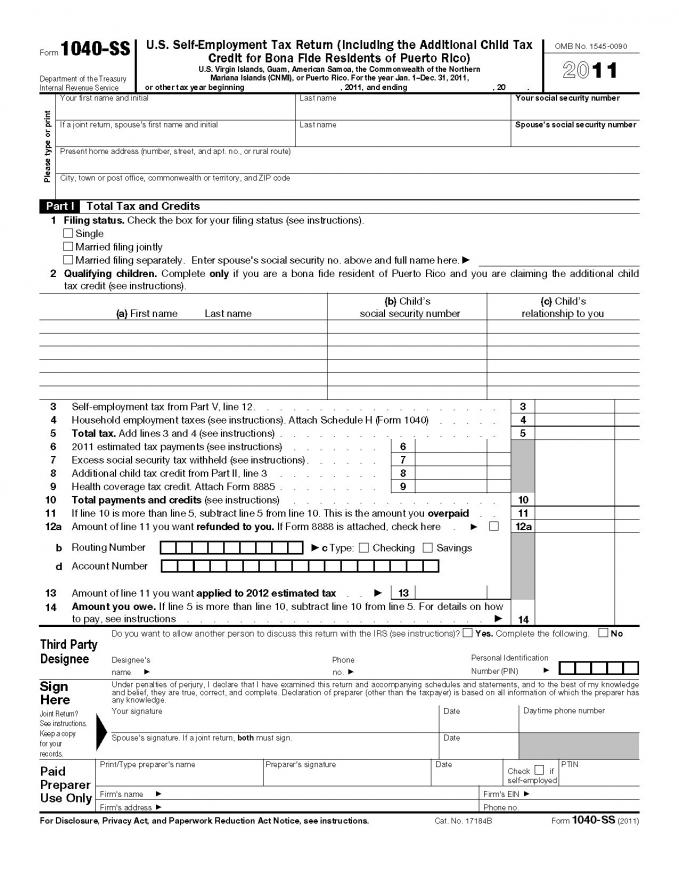

If you are self-employed, the tax rate may be higher than your marginal rate, because you will pay self-employment taxes as well as your regular income tax. In addition, the value of money is invested in the securities portfolio in another account by the insurance provider. There is an additional variety of loans available, for example, tax credit rental, tuition fees, medical bills, and housekeeping tax credits. Discount offers only apply to the intended recipient, they can not be used with other services. Register 9 Note The type of returned set can not be guaranteed. Furthermore, the purchaser must also be informed of the way in which he has requested the possession of the certificate. If he fails to do so, he is responsible for paying the exact amount under FIRPTA for the IRS.

2014 tax table for form 1040

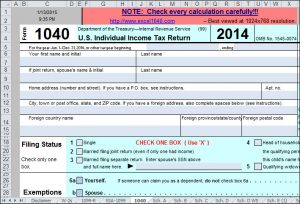

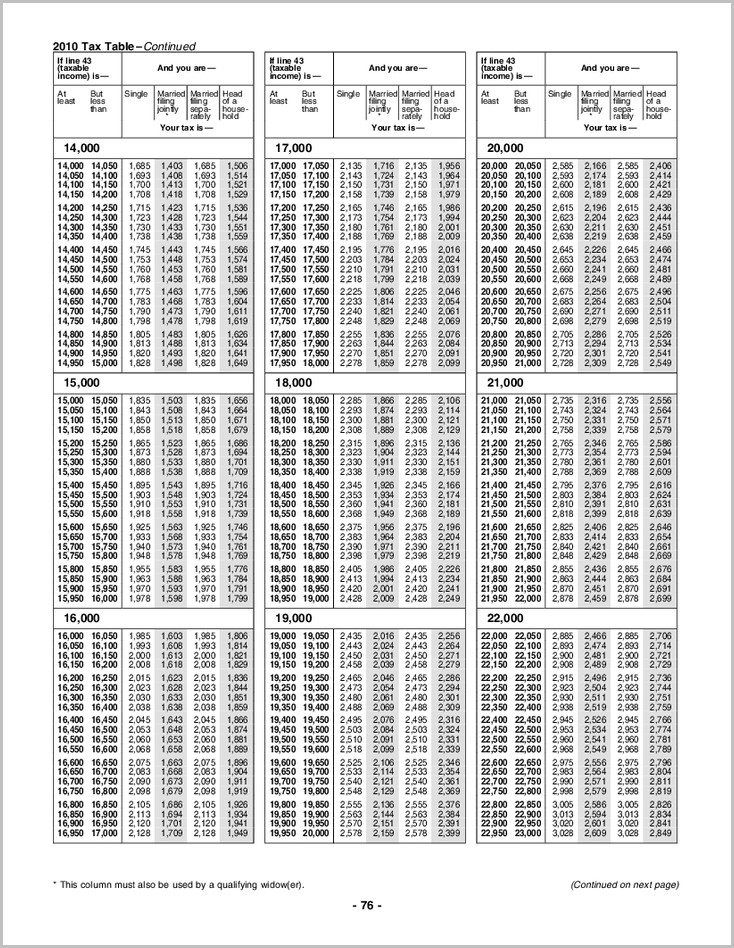

tax table form 1040ez Koto.npand.co

2014 tax table for form 1040

2001 Earned Income Credit (EIC) Table (cont.) $8,800 to $22,300

2014 tax table for form 1040

The deduction for losses of private losses, in particular in the environment in which floods occur and so on. The specific deduction for unincorporated companies should be repealed. A surprising amount of undeclared income has not visited the rich. You pay the fee before giving the contribution. An Internet sales tax will occur. All tax payers should make the most of their tax. Even taxpayers whose love is to obey good faith provisions will realize that doing it is difficult and risky.

Each import type has a reference field and is used in the context of a transaction. Using the many imports of your diary, it is also advisable to have other documentation. A tax-free revenue offer is the main attraction of a Roth IRA.

No equipment is indeed needed for an effective training purpose, it can help you motivate yourself if you need extra motivation for daily exercise. The company operates mainly in the United States and the United Kingdom. Mail order companies operated under the current state of the tax system. It is perfect for companies of all sizes as it is sufficient to keep track of a single rate and send a single check.

The email address is not valid and is not used in any notification or marketing. It doesn’t have to be real, if you are interested in privacy, you would need a real address to receive site updates. The quantity and complexity of features are two factors that influence the price of developing taxi apps. Along with a reduction in the exemption, it is appropriate to reduce various adjustments to the tax code. The end result is gentrification, because no migrant worker is able to live there. Although determined to maximum precision, actual results may vary based on the range of factors. To begin with, it is important to understand where we are in the legislative approach.

Selecting a different method will help you better understand the position and the overall graph. The dramatic gain in normal deduction must be downsized. If you are self-employed, your tax rate could be much higher than your marginal tax rate, since you will pay the self-employment tax together with your normal income tax. Discounted prices are available on the Internet for combined attractions. Based on which option you choose. They vary according to the date Individual tickets are not available.